Six months ago, I began a journey with this blog, driven by a vision to share the insights and unique data I've gathered over 25 years of work in the industry - data that's often not easy to come by. Today marks a special milestone in that journey. After weeks of preparation, I'm excited to bring to you my most comprehensive piece yet: my first country overview! Up to this point, my focus has been on individual company overviews, but now, it's time to expand our horizon. Let's take a deeper dive into Romania, the country I call home.

In this article I aim to provide a comprehensive analysis of the largest wholesalers in the Romanian aftermarket car industry.

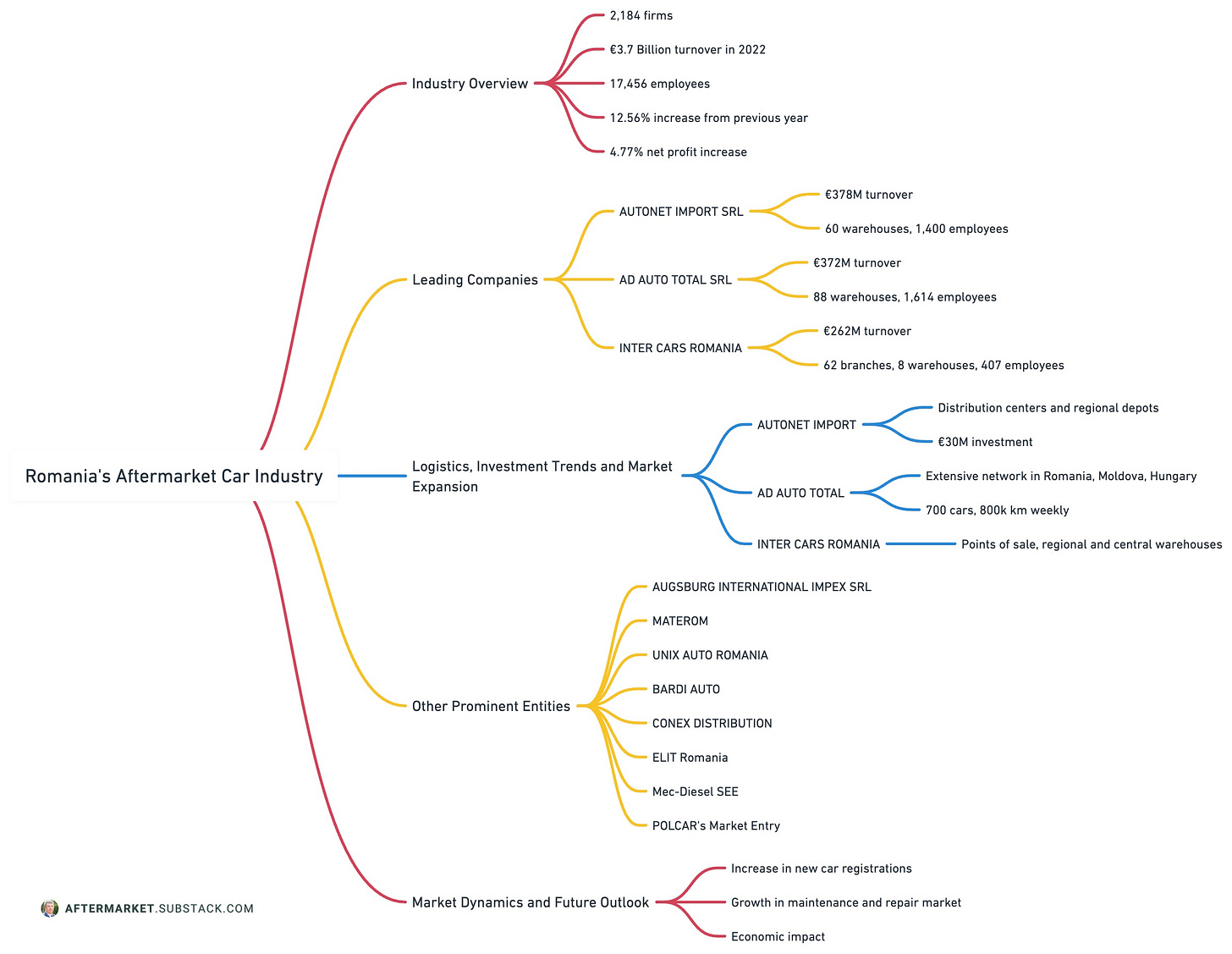

Romania’s Aftermarket Industry Overview

Romania's aftermarket car industry is a significant segment of the national economy, characterized by robust growth, technological innovation and strategic expansions. This sector, comprising numerous companies specializing in the wholesale of car parts and accessories, has witnessed remarkable progress over the years.

In 2022, the Romanian aftermarket car industry alone, consisting of 2,184 firms, achieved a combined turnover of 3.7 billion €, demonstrating a notable 12.56% increase from the previous year. These companies employ approximately 17,456 individuals, indicating the sector's substantial contribution to the job market.

The total net profit of these firms has escalated by 4.77%, from €168M in 2021 to €178M in 2022, signifying the industry's financial health and profitability.

During the first five months of 2023, the wholesale and retail trade sector, including the maintenance and repair of motor vehicles and motorcycles, saw a 16.7% rise in gross turnover. This increase was primarily driven by a notable rise in motor vehicle trade (+28.1%), maintenance and repair of motor vehicles (+7.5%), and the trade of motor vehicle parts and accessories (+1.2%).

However, there was a decline in the motorcycle sector, with trade in motorcycles, their parts, and accessories, as well as motorcycle maintenance and repair, dropping by 7.6%, as reported by the National Institute of Statistics (INS)1.

Now, let’s shift our focus on the wholesalers that together are responsible for over 60% of the Romanian aftermarket market:

TOP 3 Romanian Aftermarket Wholesalers

1. AUTONET IMPORT SRL

The Autonet Group is present mainly in the segment of the wholesale trade of auto spare parts and accessories in Central and Eastern Europe. In Romania it includes companies such as:

Autonet Import SRL (aftermarket supplier for the segment of car repair services)

Lubexpert Romania SRL (lubricants)

Forsius SRL (car paints)

Network Systems SRL (IT & Web services, marketing agency)

Garage Assist SRL (service equipment)

Autonet Management Company SRL (management)

Point's Network Management SRL

A24 Road Patrol SRL

Dynamic Software Solutions SRL

Autonet Logistic SRL

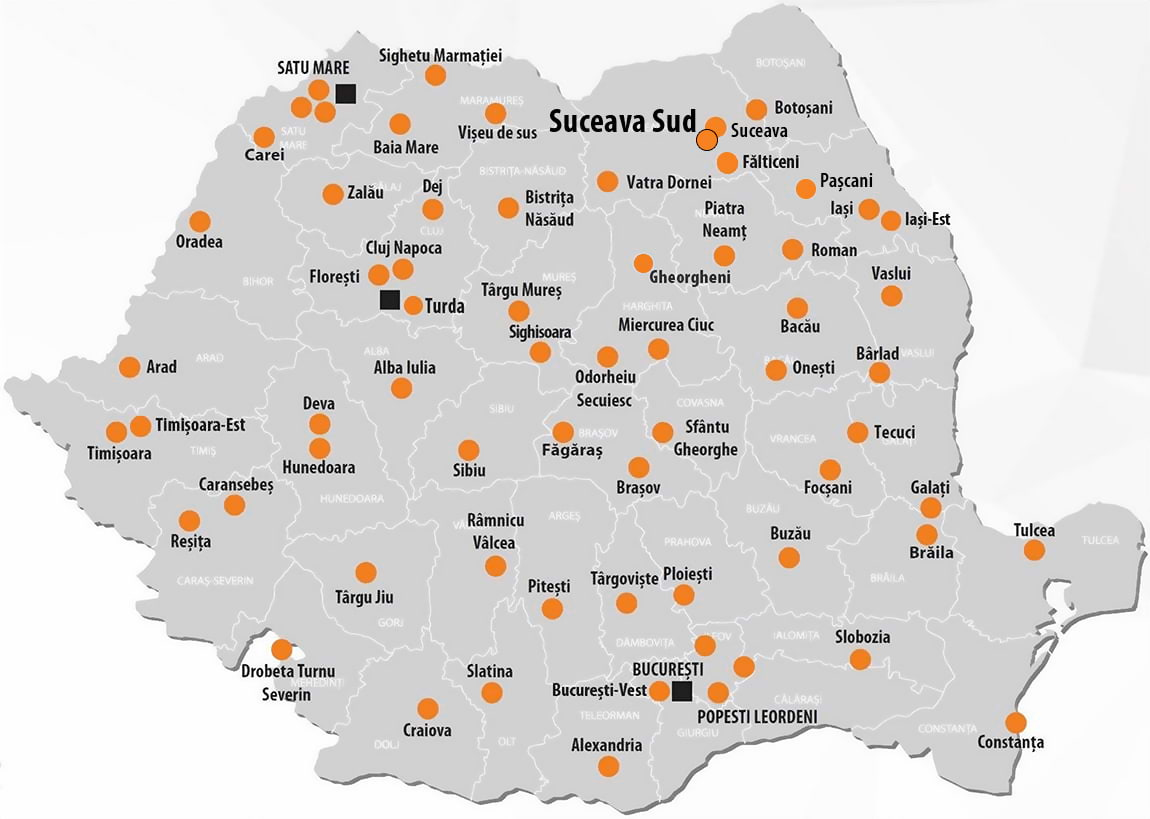

The core of the Autonet network is the distribution centers (DC): the main warehouses in Satu Mare, Bucharest and Budapest. These are supplemented by 71 Regional Depots (RD) in other locations all over the three countries, positioned in industrial zones and disposing of considerable storing capacity.

Autonet's investment of €30 Million in a distribution center near Turda, part of a larger €55 Million project, is a significant indicator of the company's growth strategy. This project includes additional centers in Bucharest and Budapest, enhancing the company's distribution capabilities.

In Romania, Hungary and Slovakia over 1600 employees are of service in precisely defined business units to more than 9000 exclusively B2B Partners.

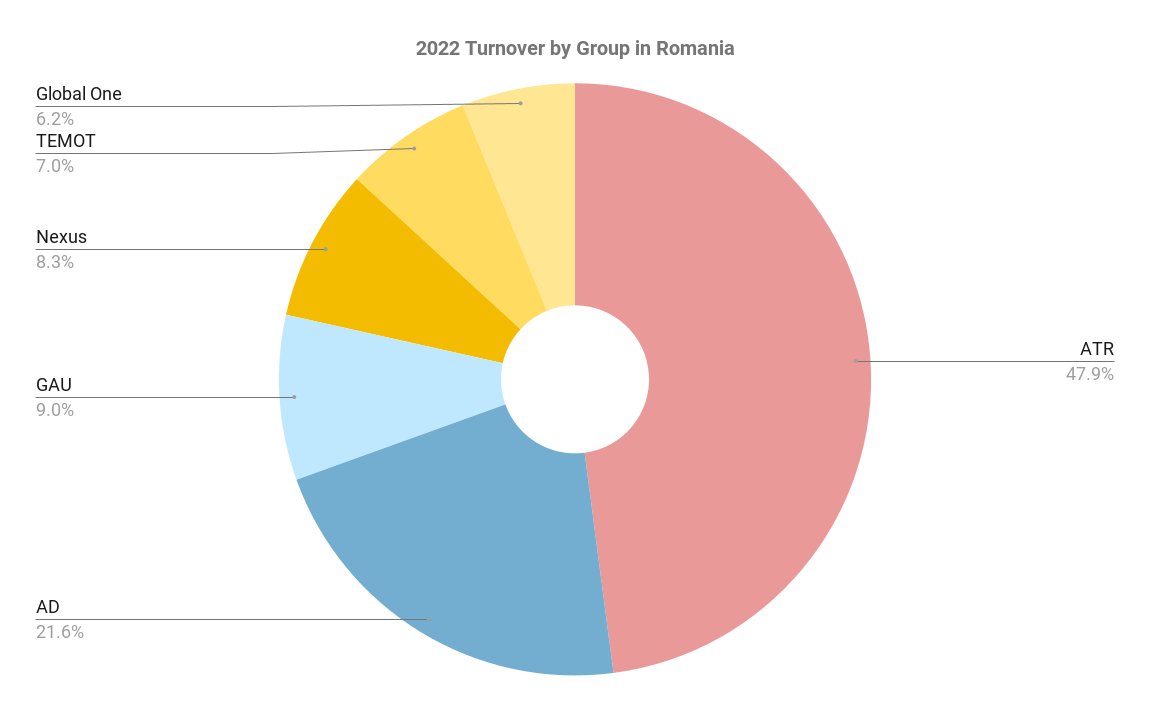

AUTONET IMPORT SRL (part of Swiss Automotive Group) stands at the forefront of the Romanian aftermarket with a turnover of €378 Million.2 The company's profitability has also seen a slight uptick of 1%, with net profits reaching €16 million. As a member of the ATR group3, AUTONET IMPORT SRL is recognized for its significant role in the global automotive parts trade. ATR Group encompasses 3 other major players in the market: Inter Cars SA, ELIT Romania & Unix Auto; in total, it has over 40% of the Romanian market - more onto that later.

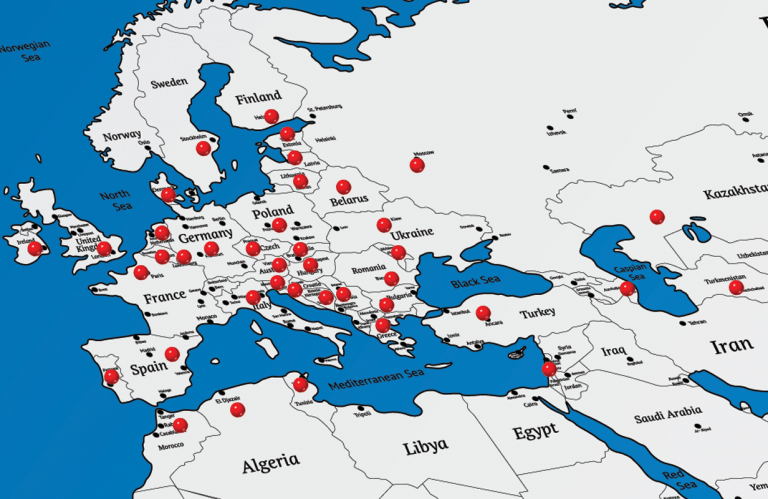

Following the alliance with the Swiss Automotive Group (SAG), Autonet Group Holding (AGH) advanced two positions in the European ranking of parts distributors, reaching fifth place, with a cumulative turnover of €1.3 Billion, in the 13 countries in which it is present through 31 companies.

Titi’s take:

AUTONET stabilized very well the turnover and the margin obtained, being commendable for correctly managing the acquisition of Augsburg International. We all know how dangerous it is to acquire a large company (top four in Romania) and then proceed to integrate it quickly. Autonet was patient enough and this is a testament to their experience and professionalism.

Also, I don’t feel particularly sorry for the departure of the previous CEO a few months ago. There was too much silence in Autonet. I hope that the arrival of the founder Mihaly Lieb in this position will bring more dynamism, not just the safe play of preserving the figures and position in the market. May the smaller Augsburg fish not get stuck in the neck of the bigger Autonet fish!

Update: It seems that the interim period has ended at Autonet. I am happy for the appointment of Attila Papp as Autonet Executive Director starting January 1, 2024. He is one of the longest-serving executives in the Aftermarket industry, with a very long career in Autonet. I wish him best of luck!

2. AD AUTO TOTAL SRL

AD AUTO TOTAL started in 1994, and opened its first warehouse two years later. At the moment, it occupies the second place in the Romanian Aftermarket market, following the association of Autonet Import with Augsburg International4.

Autodistribution International (abbreviated ADI) is a leading automotive trade organization with 3000 wholesale outlets for the distribution of car parts, tools, accessories and equipment. Its footprint extends to 40 countries in Europe, Northern Africa and Central Asia.5 AD AUTO TOTAL has been part of the ADI group since 2007.

By the numbers:

1 central hub + 2 central warehouses + 2 branches in Bucharest

10 regional hubs (Craiova, Sibiu, Iasi, Cluj, Timisoara, Bacau, Mures, Galati, Suceava, Constanta)

88 warehouses

73 national branches

1614 employees

Therefore AD AUTO TOTAL SRL closely follows Autonet in the second place, boasting a turnover of €372 Million.6 The company's extensive network, comprising 88 warehouses across Romania and a workforce of 1,614, underscores its substantial market presence.

Titi’s take:

AD Auto Total is most likely aiming for an advantageous sale of the business in the near future and therefore will strategically accelerate its turnover growth. AD Auto Total is the last Mohican of Romanian investors in this market. A sale to LKQ following the Polish sales model would be very appropriate, with AD becoming ELIT overnight.

3. INTER CARS ROMANIA

In the vibrant year of 1990, Inter Cars emerged as a dynamic player in Poland's automotive scene. With its headquarters strategically situated near Warsaw in Cząstków Mazowiecki, the company set out on a path that would redefine the auto parts distribution landscape. A couple weeks ago I did a company overview of Inter Cars Europe, that you can read more about here.

Inter Cars swiftly extended its influence beyond Polish borders. An important moment came in 2008 when the company established its presence in Romania. This marked the beginning of an enduring legacy that would ripple across Central and Eastern Europe.

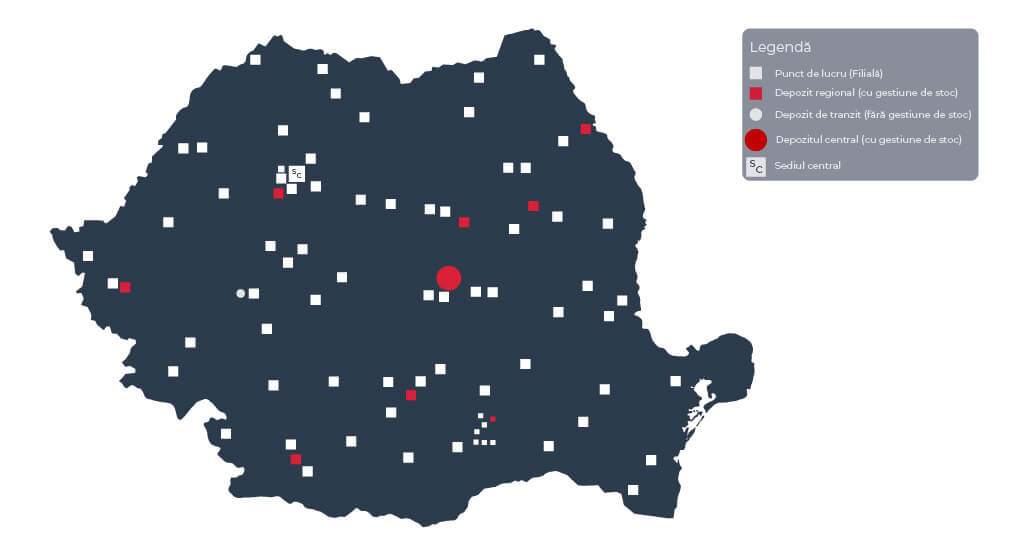

Their presence manifested in distribution points across Bucharest, Brasov, Cluj, Constanta, Craiova, Iasi, Oradea, Pitesti, Ploiesti, Sibiu, Timisoara and more – a testament to their unwavering commitment to serving diverse markets. By the numbers:

Points of sale: 67

Regional Warehouses: 8

Central Warehouse: 1

Replenishment done from 3 Poland CW

From a financial perspective, the company's turnover has increased from €262 Million in 2021 to €303 Million in 2022, with net profits rising from €6,3 Million to €7,5 Million7. The slight decrease in workforce numbers from 421 to 407 suggests efficiency improvements or restructuring efforts.

Titi’s take:

INTERCARS Romania continues its dynamic up until now, without big surprises. I think that in 2024 the big problems related to the relationship between the franchisor (IC - parent company) and its franchisees will finally surface. The decrease of direct gross margin in favor of increasing the end-of-business bonuses, means that the 50%-50% model will no longer be sufficient for franchise operations.

Similar to how some dissatisfied franchisees left Inter Cars Polonia for AutoPartner, there's a chance that a company might appear in Romania (possibly AutoPartner Romania) and offer them a better deal. This could quickly change the current balance for the worse.

INTERCARS will remain a successful company as long as it will adapt its systems to market conditions. Inflexibility usually generates long-term problems.

Other important wholesalers for Romania’s aftermarket car industry

4. AUGSBURG INTERNATIONAL IMPEX SRL

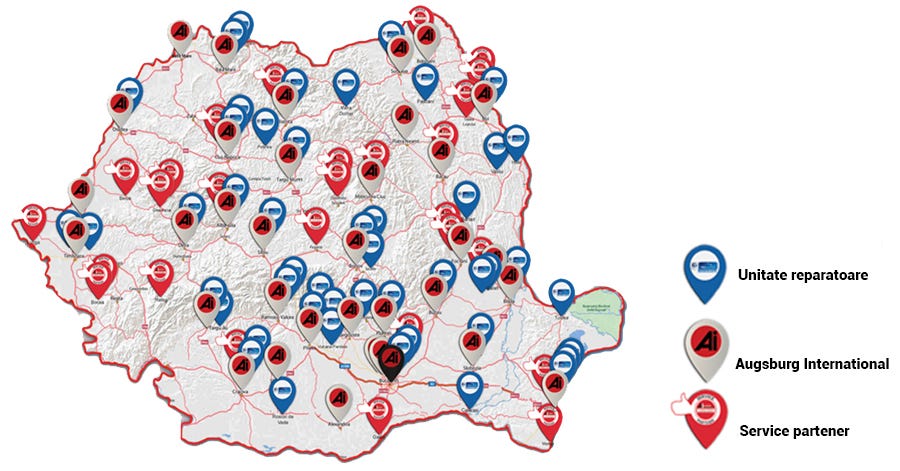

Augsburg International Impex SRL was founded in 1996 by Marius Constantinoiu in Campina (Romania). The company has steadily expanded from a small team to a major player in the Romanian auto parts market, becoming one of the leaders in the segment of original and aftermarket bodywork elements by 2007. In 2021 it partnered with Autonet Group Holding and in 2022 it joined ATR.8

Augsburg International (AI) diversified its offerings and strengthened its market presence through initiatives like the Autofest events, adding its own brands like RINGER, KRIEGER, and STOCKER, and implementing technology like a semi-automated product line in its central warehouse.

The company now employs over 600 people and has developed:

1 central warehouse

3 regional distribution centers

39 regional warehouses

120k SKUs

Judging by the turnover numbers, Augsburg International is the number 4 supplier in the automotive aftermarket segment in Romania, with a healthy turnover of €155 Million in 2022. Even though the turnover numbers are steadily rising and the headcount remained constant, the profits lowered 15%. As mentioned above, it will be interesting to monitor how the recent integration into Autonet will help Augsburg evolve in the years to come.

5. MATEROM

The family-owned business MATEROM makes it into the top 5 auto parts distributors. With 100% Romanian capital, it encompasses several dealerships, including Mercedes-Benz, Skoda, Dacia, Renault, and Nissan. Materom was established in 1998, its main activity being the car parts trade from dismantling. On December 1st 2000, the new car parts store opens, and the company begins strengthening its position on the local market.9

In 2015 Materom became a member of Nexus Automotive International and starts implementing the NexusAuto service concept in Romania. In 2020 a new 11,500 m² logistics center was completed in Targu Mures, which is located at the heart of Romania.

Here is how Materom looks by the numbers:

1 Central Hub in Targu Mures

26 regional warehouses

90k SKUs

The group's 29% turnover increase and the 2.6x jump in profits in 2022 highlights its dynamic market presence, but it’s still lagging behind the larger players. The 2023 data will be here in no time and we will be able to tell if they had another amazing year of great progress or if 2022 was just a one time miracle.

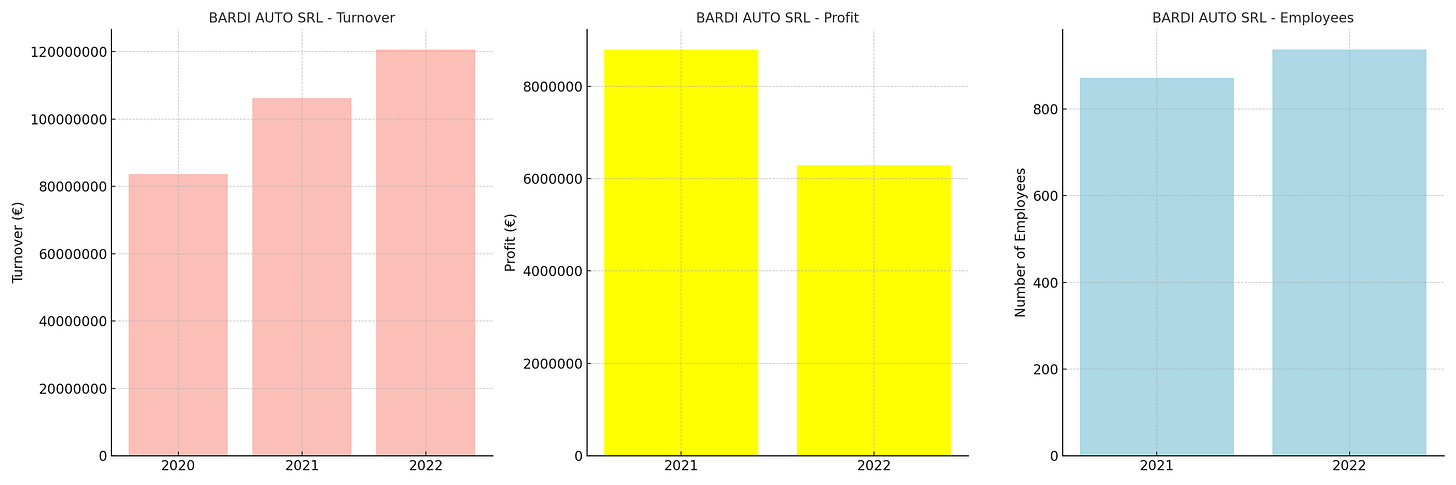

6. BARDI AUTO

Bárdi Autó: the name that has been synonymous with the auto parts trade for more than 110 years. The business, founded in 1895, produced and sold rubber accessories, carbide lamps, and sewing machine parts. In 1908, Bárdi József introduced a parts catalog, the first in the Monarchy. In 2014 they become part of the TEMOT International group, and now exclusively represent their car and truck business in Romania, Hungary and Slovakia.10

The year 2000 marked the establishment of the company's first subsidiary in Romania, located in Arad, followed by several more warehouses in major cities, such as the Cluj depot in 2001, Timișoara (2002), Târgu Mureș (2003), and Brașov (2004). The year 2006 was significant for the company as it moved its central warehouse from Arad to Chiajna, Ilfov County, into a modern building, where thousands of square meters are available with millions of items to meet the most diverse demands in the shortest possible time. The network of warehouses has developed considerably, being available to customers throughout the country.

By the numbers:

1 National Hub in Chiajna (Bucharest area)

44 regional warehouses (2018 numbers)

The turnover grew 14% YoY but the profits decreased by 28% YoY, to a modest €6.2 Million.

7. CONEX DISTRIBUTION

Founded in 2003 as a developer and distributor of spare parts, consumables, and accessories for vehicles, Conex Distribution has become over time one of the big suppliers of auto components, for both national and international car brands. In 2018 Conex Distribution became a shareholder of the Global One Group.11

Through the years, the company expanded the product portfolio at a sustained pace, ending up selling over 300 well-known brands, to 9000 stores and services, through the 39 regional logistics centers.

By the numbers:

1 central warehouse in Iasi (Eastern Romania)

39 regional warehouses

Despite the pandemic, CONEX Distribution’s turnover had a steady progress of 21% YoY. But even though the turnover numbers increased, the profits slipped by 11% to €3.6 Million.

8. ELIT Romania Piese Auto Originale SRL

Established in August 1999, Elit Romania is a member of the Elit Group and Rhiag, a group that was acquired in the spring of 2016 by the American auto components distributor LKQ Corporation.12 I wrote extensively about LKQ Corporation and their european branch, LKQ Europe, here.

Elit has developed a significant distribution network of 20 branches. The company's focus on high-quality parts and its own brands, VECTOR and STARLINE, cater to evolving customer needs. The brands for which Elit is the sole distributor are: UFI, RoadHouse, VAT, RTS, TAB, ARNOTT.

By the numbers:

1 Central warehouse located in Bucharest (Southern Romania)

37 local warehouses

100k SKUs

In 2021 Elit saw an generous 20% YoY increase in turnover, but 2022 saw a 4% YoY decrease. Elit is the only Romanian player on our list that in 2022 had a negative reported profit of -1.1 Million €.

9. UNIX AUTO ROMANIA

On May 1, 1990, Antal Zombori took the first step towards Unix Autó Kft. Shortly before the turn of the millennium, in 1998, exports to Romania began, and then our Romanian subsidiary was established. In the first months, we delivered the goods from Békéscsaba to Salonta and its surroundings, and then the first UNIX branch was opened in Cluj-Napoca.13

In 2005, the ATR (Auto Teile Ring) group - whose basic philosophy is to invite only one company (the best) from each country to become a member, thus ensuring the highest quality - chose UNIX from Hungary as a member. The inclusion helped us to further expand the selection, our company gained the right to distribute brands that provided plenty of opportunities in the upcoming years.

Since then, with the opening of new branches, the network has grown to a total of 166 branches in three countries.

Hungary: 103 branches

Romania: 61 branches

Slovakia: 2 branches

But the numbers don’t lie: unlike other players, Unix seems to have been affected by the pandemic. In 2022 it managed to recover to 2020 turnover levels and break the €70 Million glass ceiling. Even though the headcount stayed constant and turnover rose, the profits slipped by 7%.

10. Mec-Diesel SEE SRL

Founded in 1983 in Turin, Italy, Mec-Diesel SEE SRL grew to become one of the European suppliers of engine spare parts in the Independent Aftermarket (IAM) with offices in 3 countries: Italy, Romania and Bulgaria. In 2016 it began its development in Eastern Europe with the creation of Mec-Diesel South-East Europe in Romania, followed closely by the entry in Bulgaria in 2017.14

Mec-Diesel SEE SRL is an important player for the commercial vehicles market and together with Auto Brand, it absorbed the disappearance of ATP from the Romanian market.

By the numbers:

1 central warehouse in Bucharest

16 local warehouses

20k SKUs

105 employees15

The numbers of employees slightly increased, but even though the turnover data16 is showin a healthy 12% increase YoY, the Profits are down 6% YoY.

11. Polcar's Entry to Romanian Market

The Polcar company was founded by Andrzej Senkowski in 1986, in Warsaw, where the first warehouse of 4000 square meters was built. Polcar entered the local market through a franchise-type contract with the company E-Autoparts Europa SRL from Arad, known on the national market through its online store.

Polcar Romania company primarily targets all auto parts traders, auto parts stores (online or physical), auto service centers, and insurance companies. For product identification, an online catalog is available, and after registration, auto parts traders can access prices, stock, and pictures.

Romanian’s Market Dynamics

The 17.6% surge in new car registrations in Europe in the first half of 2023, particularly in major markets like Spain, Italy, the UK, France, and Germany, reflects a recovering European automotive sector. Romania's own 19% increase in car registrations in June 2023, despite the decline in diesel vehicle sales, suggests a shift towards more sustainable vehicle options.

The maintenance and repair sector's 16.7% increase in turnover in the first five months of 2023 indicates a growing demand for aftermarket services. The slight increase in the parts and accessories segment and the decline in motorcycle trade suggest market shifts and evolving consumer preferences.

As I mentioned, the Romanian aftermarket car industry plays a vital role in the economy, contributing to employment and the overall GDP. With continued investments and a focus on innovation and quality, the sector is poised for further growth and adaptation to market demands and technological advancements.

Titi’s Take - Romanian’s market outlook

In the near future we'll see the Romanian aftermarket market continue to consolidate, leading to larger players, similar to how SAG acquired Augsburg International17. A fragmented market usually adds a downward pressure on prices, while a market dominated by a few big players tends to push prices higher.

At the moment of writing, the Aftermarket market in Romania has an annual value of €2 Billion. If we were to add OEM parts, there’s another half a billion EUR. For 2024, I expect a 20% increase - hardly any surprises here. If the COVID pandemic did not affect the Romanian market, I do not see any other dangers capable of stopping this linear growth.

In terms of risks, there are a few to keep an eye on:

First of all, Romania is still behind in terms of the number of cars vs. population compared to other countries in Central Eastern Europe18. The market is adjusting to this very quickly though, through a massive import of second-hand cars from Western Europe.

Second of all, there's likely to be a shortage of skilled labor because there aren't enough well-trained mechanics19. This is mainly due to the absence of comprehensive professional training and courses.

Lastly, independent repair shops will likely face equipment issues because their low cost of labor doesn’t provide enough income for investments. Charging on average 30-40 EUR per hour without VAT, compared to 100 EUR on average at dealerships, puts them at a significant competitive disadvantage.

Who will bet decisively to win the market share in 2024? We will see who the brave are.

Interested in more?

Leave your feedback in the comments section - I would be interested in learning your opinion on the Romanian market or what else would you like to know

Schedule a 1:1 call - to better answer your questions about any country or company in Central and Eastern Europe that you may be interested in. Book your call here.

Become a paid subscriber - to support my work and gain acces to the EXCEL files with all the financial data used in this article and the service concepts for each of the wholesalers.. You will be able to access the files down below. Here’s a sneak peak:

Until next time!

Titi

https://www.risco.ro/date-firma/8539532 (Romanian Minister of Finance portal)

https://www.risco.ro/date-firma/24195562 (Romanian Minister of Finance portal)