[Company Overview] AAG: Alliance Automotive Group

A Journey of Expansion and Innovation in the European Automotive Aftermarket

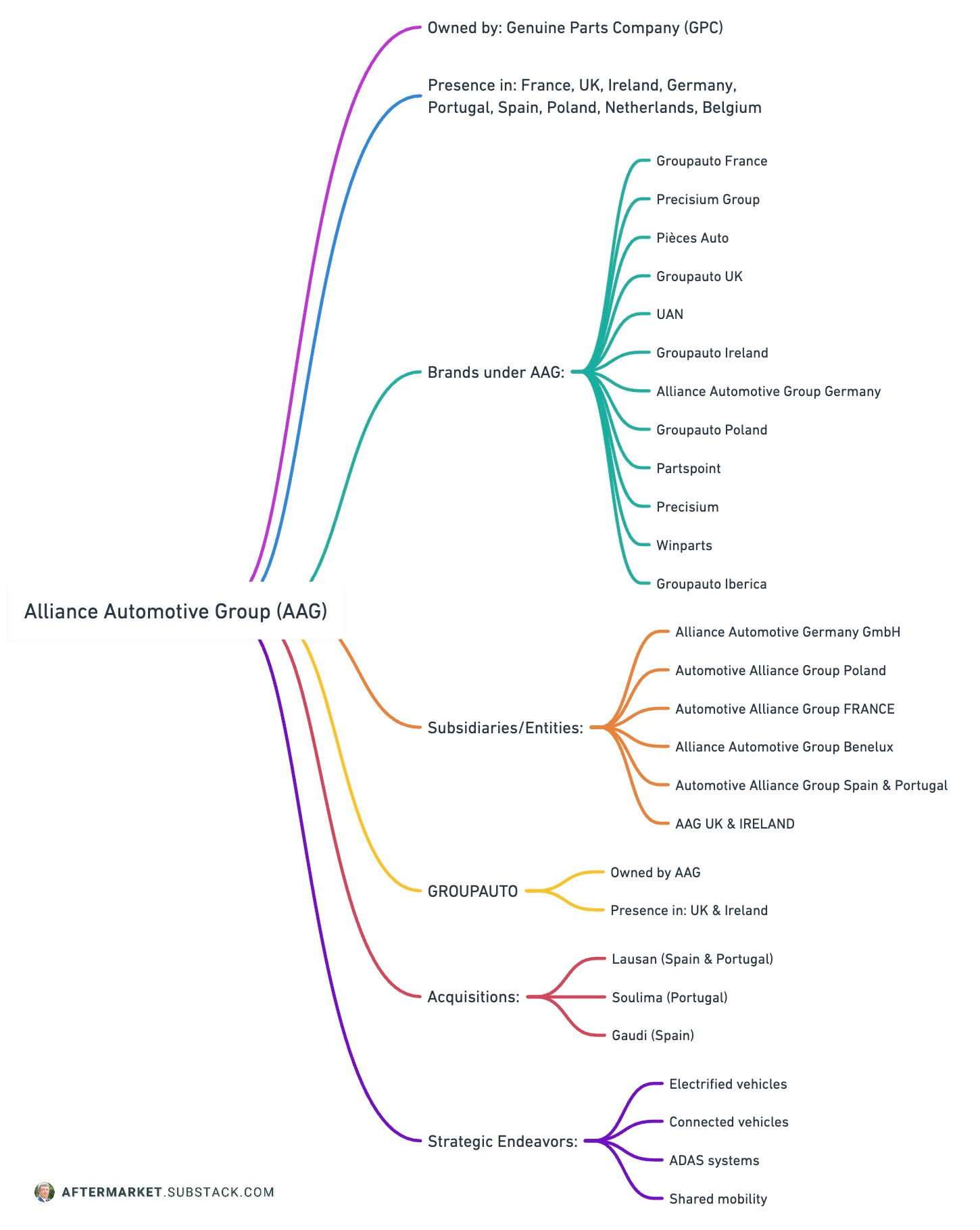

Alliance Automotive Group (AAG) is a key player in the European logistics framework, specializing in the distribution of automotive and commercial vehicle parts across diverse markets. Through strategic expansions, AAG has significantly widened its reach in the European independent aftermarket. Central to its operations is a robust network of both company-owned and affiliated distributors, spanning across various countries with a notable presence in France, the UK, Ireland, Germany, Portugal, Spain, Poland, the Netherlands, and Belgium.

As the automotive industry embarks on a transformative journey over the next decade, with shifts towards electrified and connected vehicles, AAG is at the forefront, ready to lead the industry through these evolving technologies. The strategic endeavors of AAG are further bolstered by its ownership under the reputable umbrella of Genuine Parts Company, marking it as a segment of the world's largest automotive aftermarket corporation.

Genuine Parts Company

The expansive network of Genuine Parts Company (GPC) spans across the automotive replacement parts, accessories, and service items sector, stretching across the U.S., Canada, Mexico, Australasia, and numerous European nations including France, the U.K., Ireland, Germany, Poland, the Netherlands, Belgium, Spain, and Portugal. Within the North American domain, the company boasts the distribution of over 725,000 parts, predominantly under the renowned NAPA brand, synonymous with quality products, excellent service, and expert personnel.

Venturing into Europe, GPC is gradually establishing the NAPA brand, offering a range of quality products under diverse banners such as GROUPAUTO, Precisium Group, Pièces Auto, UAN, Alliance Automotive Group, PartsPoint, Lausan, and SOULIMA. On the other side of the globe, GPC Asia Pacific caters to the Australasian market primarily through the Repco and NAPA brand umbrellas.

Established in the year 1928, Genuine Parts Company has evolved into a global service entity dedicated to the distribution realms of both automotive and industrial replacement parts. The Automotive Parts Group of the company orchestrates the distribution of automotive replacement parts across numerous nations in North America, Australasia, and Europe. Concurrently, the Industrial Parts Group oversees the distribution of industrial replacement parts within the U.S., Canada, Mexico, and Australasia. Encompassing a vast network stretching over more than 10,000 locations across 17 countries, GPC employs a robust workforce of around 58,000 individuals, diligently serving a global clientele. You can read more here.

Alliance Automotive Group

Through a blend of organic and external expansion, Alliance Automotive Group (AAG) has broadened its reach, now encompassing over half of the European independent aftermarket. The acquisition of AAG by Genuine Parts Company (GPC) in 2017 positioned it as a segment of the world's largest automotive aftermarket corporation.

AAG addresses the extensive automotive aftermarket needs via a robust network of both company-owned and affiliated independent distributors, boasting over 1,000 sales points in France, upwards of 800 in the UK and Ireland, beyond 70 in Germany, over 35 in Portugal and Spain, 250 in Poland, and 186 outlets in the Netherlands and Belgium.

With a continually expanding European network and a solid history of growth, we are perpetually enhancing our offerings in the automotive sector. The automotive aftermarket exhibits vigor, driven by increasing mileage, an expanding and aging car park, alongside a sturdy used car market.

The automotive sphere is amidst a transformation set to unfold over the coming 10-20 years. Headlines are rife with the shift towards electrified vehicles, advancements in ADAS systems, the rise in connected vehicles, and the growing inclination towards shared mobility, collectively termed as “emerging technologies” within our company.

AAG is poised to lead the industry, equipping technicians for these evolving technologies. Our strategy encompasses leveraging our global presence, diversifying our product range, forging alliances with premier suppliers, and comprehending the workshop milieu. These ventures present a transformational avenue to foster technician allegiance, and for AAG, to seize a greater market share and revenue stream.

AAG has built a reputation as a prominent distributor of parts for light and commercial vehicles to the independent aftermarket across France, the U.K., Ireland, Germany, Poland, the Netherlands, Belgium, Spain, and Portugal. Operating under diverse brand banners such as Groupauto France, Precisium Group, and Pièces Auto in France; Groupauto UK and UAN in the UK; Groupauto Ireland in Ireland; Alliance Automotive Group Germany in Germany; Groupauto Poland in Poland; and Partspoint, Precisium, and Winparts in the Netherlands and Belgium, with Groupauto Iberica extending its reach in Spain and Portugal. Catering to around 100,000 garages, AAG provides an extensive range of over 100,000 distinct parts for repair and maintenance, channeled through a robust network of more than 700 company-owned stores and in excess of 1,700 affiliated outlets.

Operating as a fully owned subsidiary of Genuine Parts Company, AAG continues to broaden its operational horizon across North America, Europe, and Australasia, contributing to its parent company's expansive distribution ventures. You can read more here.

Groupauto

GROUPAUTO is owned by Alliance Automotive Group; GROUPAUTO operates under the umbrella of Alliance Automotive Group, providing parts and associated technical expertise to over 25,000 establishments ranging from car and commercial vehicle repair centers, garages, quick-service outlets, body shops to specialist and DIY chains. I wrote a company overview about GROUPAUTO CEE, the Central and Eastern European branch of GROUPAUTO, at this link.

Alliance Automotive Group (AAG) holds membership and stands as the largest shareholder within GROUPAUTO International, encompassing GROUPAUTO UK & Ireland.

With a notable presence anchored in the core of the territories through its 17 logistics hubs and a network of 1000 subsidiary or partner sales outlets, AAG fortifies its leading stance, ensuring daily deliveries to 4,500 repairers.

At a high level, here is a timeline of AAG, from its inception in the 70’s all the way to 2023 with its latest acquisition:

History of AAG

1974

Inception of Factoring Services Group

Arnold Parker founded the Factoring Services Group (FSG), laying the groundwork for the buying group which later evolved into GROUPAUTO UK & Ireland Ltd.

1997

AAG's Foray into the UK

Alliance Automotive Group (AAG) marked its entry into the United Kingdom by acquiring Factoring Services Group. In the same year, a stake in Groupauto France group was also acquired.

2002

Debut of AutoCare Network

The AutoCare garage network program was initiated in the UK, forming a part of the global network, EUROGARAGE.

2011

Unveiling of G-Logix Central Distribution Centre

GROUPAUTO launched a central Distribution Centre, initially named G-Logix. By 2016, it transitioned from Light Vehicle (LV) products to a dedicated Commercial Vehicles (CV) product Distribution Centre, rebranded as CV Logix.

2013

Acquisition Spree Continues with Precisium Group

The acquisition of the Precisium group and its distribution platform in Sainte-Geneviève-des-Bois (91) took place.

2014

Introduction of the Hub

“The Hub”, a unified order portal linking all group's logistics platforms, was launched.

2015

Series of Acquisitions and Launches

This year witnessed the acquisition of UAN group in the UK, Coler distributor in Germany, and SAS platform specializing in bodywork, alongside the launch of "Preference Platforms" in France, amalgamating all regional platforms of the group.

2016

Expansion with Lookers Parts Division and CV Logix Centre

AAG acquired Lookers Parts Division encompassing FPS, Apec Braking & BTN Turbo. CV Logix Central Distribution Centre, dedicated to Commercial Vehicles (CV) products and based in Bradford, also commenced operations.

2017

Mega Acquisition by Genuine Parts Company

Genuine Parts Company, a global leader established in 1928, acquired Alliance Automotive Group, forming the largest automotive aftermarket company globally. Additionally, majority stakes in Groupauto Poland and JVP along with its Auto Parts franchise network in France were acquired.

2018

Acquisition Trail and AAG's Battery and Lubricant Domain Entry

Acquisitions included distributor Hennig in Germany and Platinum International in the UK, the latter being the largest independent battery and lubricant distributor.

2019

Branding, Acquisitions, and Transformation Project

AAG launched NAPA own brand and Primetool own brand in France, acquired Todd company and Dutch distributor PartsPoint, and initiated AAG France's transformation project named One.

2020

Shared Service Center and Stake Acquisition

AAG France's shared service center, Hexagon, was established in Vern-sur-Seiche (35), and a stake in Groupauto Unión Ibérica was acquired.

2021

Digital and Physical Expansion

Launch of the Auto Parts group, acquisition of Winparts website, a Dutch online auto parts seller, and J&S distributor in Ireland occurred.

2022

Venturing into Electric and Hybrid Repair

Acquisitions included Lausan in Spain & Portugal, and Knoll in Germany. Nexdrive, a label for electric and hybrid vehicle repair, was launched.

2023

Acquisition Milestone with Gaudi

On July 31, 2023, AAG, a subsidiary of Genuine Parts Company (NYSE: GPC), acquired Recambios y Accesorios Gaudi, S.L. (Gaudi), a leading independent entity in Spain with 22 stores, primarily in Catalonia and Madrid regions, boasting an annual revenue of approximately €100 million ($110 million USD), reflecting the expertise of the Gaudi team across all automotive segments.

"We are pleased to expand our European Automotive footprint with the addition of Gaudi (…) With this acquisition, we are broadening our leadership position in Spain, Europe's fifth largest automotive market, while extending the opportunities for rollout of the NAPA brand and enhancing the profitability of our European business. The synergies provided by this transaction will enable us to grow more effectively and allow us to provide even greater customer service throughout the country. We welcome the Gaudi team to the GPC and AAG family and are excited to work together to maximize the growth opportunities in our European business," said Paul Donahue, Chairman and Chief Executive Officer of GPC

The incorporation of Gaudi further strengthens AAG Iberia's strategic position in the automotive aftermarket, building on the previous establishments of Lausan in Spain and Soulima in Portugal.

European branches of AAG

Alliance Automotive Germany GmbH (AAGG)

Alliance Automotive Germany GmbH represents a pivotal arm of the broader Alliance Automotive Group, fortified with a strong presence in the German automotive aftermarket sector. With a focus on distributing automotive parts and accessories, the company serves as a vital conduit between manufacturers and a diverse range of automotive service providers. Nestled in the robust automotive landscape of Germany, known for its rich heritage of engineering excellence and automotive innovations, Alliance Automotive Germany GmbH leverages a network of distribution centers, retail outlets, and strategic partnerships to ensure a seamless supply chain.

88 Sites

2,200 Staff Members

600 Million EUR Revenue in 2022

100% Fleet Coverage Nationwide

Excess of 100,000 Varied Spare Parts for Cars and Commercial Vehicles

Automotive Alliance Group Poland

In 2017, AAG expanded its footprint by acquiring GROUPAUTO Poland, a prominent automotive parts distribution network accounting for 20% of the aftermarket sector. The details of this acquisition and the market dynamics are as follows:

GROUPAUTO Poland boasts a network of 250 distinct outlets under the umbrella of independent distributors.

This network engages over 3,500 personnel, generating collective revenues nearing €550,000,000.

Poland emerges as the largest market in Central and Eastern Europe, with the automotive sector being a significant contributor to the economy.

The country hosts a substantial car park, comprising roughly 16.1 million passenger cars and 3.04 million commercial vehicles.

The vehicle density stands at about 410 vehicles per 1000 individuals.

A notable portion, over 80%, of the vehicles navigating Poland's roads are aged over 10 years, with an average age of 12.8 years, signaling a thriving opportunity for the automotive aftermarket to flourish.

GROUPAUTO Poland encapsulates 12 businesses catering to both passenger car and commercial vehicle aftermarket needs nationwide.

Automotive Alliance Group FRANCE

France holds the title of the 2nd largest manufacturing industry in Europe, housing 38 million vehicles. The aging vehicle park propels the growth of the French automotive aftermarket, while the advent of connected cars, hybrid vehicles, and a decline in diesel usage introduces new dynamics to this vibrant market.

AAG France stands as the preeminent distribution network in the French automotive aftermarket, boasting sales figures of €1.2 billion and a robust workforce of 4,400 employees.

The network is an amalgamation of three national networks namely, Groupauto, Precisium, and Pièces Auto, all dedicated to supplying auto parts and equipment to a plethora of vehicle repairers, body shops, and auto-centers.

These French networks collectively span over 1000 outlets, with 238 being subsidiaries.

The synergy of these four networks significantly augments the efficiency in servicing the French automotive aftermarket.

AAG is distinguished as the sole player in the French market extending a comprehensive range of automotive spare parts. This includes:

Multi-brand parts for Light Vehicles (LV) and Trucks.

Technical parts.

Re-used parts.

Garage equipment.

Body refinishing supplies.

Not to mention, its exclusive distribution brands.

AAG operates from 17 distribution centers scattered across France, orchestrating its operations from its headquarters nestled near Paris in Levallois-Perret.

Alliance Automotive Group Benelux

Alliance Automotive Group Benelux serves as the brand identity for operations in the Netherlands and Belgium, and is the hub where the international back-office company, Alliance Automotive Services, functions.

AAG Benelux is adept in the distribution and sale of automotive parts and accessories, primarily through its PartsPoint stores located in Belgium and the Netherlands.

Being an integral part of the AAG family, AAG Benelux, in conjunction with Alliance Automotive, ranks among the most substantial players in the European aftermarket scene.

Investments have been channeled towards the enlargement of six parts depots, designed to bolster the supply chain for the network of outlets and wholesale units, which include:

130 PartsPoint outlets.

25 Precisium units.

30 Alliance Automotive Trading wholesale units.

The strategic investments and the well-established network underscore AAG Benelux's commitment to ensuring a seamless supply chain, thereby bolstering its position in the automotive aftermarket sector within the Benelux region.

Automotive Alliance Group Spain & Portugal

Automotive Alliance Group Spain & Portugal stands as a pivotal entity in propelling the automotive market, given the substantial number of vehicles in both regions—22.4 million in Spain and 4.6 million in Portugal. The aging car park, with average ages reaching 11.9 in Spain and 12.1 in Portugal as of 2022, paves the way for a thriving aftermarket.

AAG made its foray into the Spanish and Portuguese markets in 2022, through the acquisition of Lausan and its subsidiary Soulima.

Lausan, with its expansive network of 39 branches supported by national and regional distribution centers in Spain, further extended its reach in Portugal post the 2019 acquisition of Soulima, operating 7 branches under the Soulima brand, backed by two distribution centers located in Lisbon and Porto.

Headquartered in Bilbao, Lausan Group oversees over 43,000 workshops across Spain and Portugal, registering net sales of €112 million in 2021.

Established in 1989, Gaudi has emerged as a leading independent force in the Spanish automotive sector, boasting 22 stores primarily in the Catalonia and Madrid regions.

The enterprise has witnessed significant growth over the years, both organically and through the opening of numerous stores, culminating in annual revenues close to €100 million ($110 million USD).

The strategic acquisitions and operational expansion by AAG bolster its position in the Spanish and Portuguese automotive aftermarket, catering to the evolving demands spurred by the aging vehicle demographic.

AAG UK & IRELAND

The United Kingdom, with its robust fleet of approximately 32.7 million passenger cars, witnesses a substantial annual expenditure of around £21.1 billion on parts and servicing. This vast automotive landscape is catered to by over 42,000 establishments encompassing garages, service centres, dealerships, and repairers. The ever-ageing vehicle parc coupled with the escalating complexity of parts fuels the continuous growth of the UK aftermarket.

Alliance Automotive Group UK (AAG UK) emerges as a frontrunner in distributing light and commercial vehicle parts to the automotive aftermarket, extending its services to over 30,000 repairers across the UK and Ireland.

It houses two distributor networks, namely GROUPAUTO UK and the United Aftermarket Network, drawing logistic and product support from its wholly-owned subsidiaries FPS, Apec, Platinum, BTN Turbo in the United Kingdom, and J&S Distribution in Ireland (acquired in 2021).

The consolidated revenue figures hover around €650 million, with a strong workforce of over 3,000 employees spread across 800+ distributor outlets.

The amalgamation of these ventures furnishes the associated members and garages with market-leading commercial terms on exclusive private label brands, alongside original equipment (OE) or OE-matched quality suppliers.

Both affiliated and wholly-owned distributors are granted access to an array of business services. This includes:

Fleet deals.

Branding opportunities.

Utility services.

Marketing support.

The enduring trend of an aging vehicle park and the rising intricacy of automotive parts propels the upward trajectory of the UK aftermarket, offering a fertile ground for AAG UK to further cement its position and extend its service offerings.

Interested in more?

Schedule a 1:1 call - to better answer your questions about any country or company in Central and Eastern Europe that you may be interested in. Book your call here.

Become a paid subscriber - to support my work and gain acces to the raw financial data used in my articles, together with the service concepts for each of the wholesalers in various countries

Buy other documents - Access the full data in this article and other documents with raw data here.

Leave your feedback in the comments section - I would be interested in learning your opinion on this and other topics!