Czech Republic's Aftermarket Car Industry in 2023

A comprehensive overview of the biggest wholesalers in the market

Every country has its own culture and specifics. This holds true for language, customs and even the automotive aftermarket market! After a couple weeks spent refining the information and putting together the data, we can finally take a closer look at how much different is Czech Republic’s market than that of Romania’s (you can check Romania’s country overview here). Much thanks to my Czech colleague, Jakub Vitek, who helped me in his own time to gather the data for this extensive overview!

On that note, all paid subscribers already have access to all the raw financial and garage concepts data that I used in the making of this article, going back all the way to 2010. If you would like to learn more or download the data without becoming a paid subscriber, access this link. And now, without further introductions, let’s dive right into it!

Czech Republic’s Automotive Market Overview

The Czech Republic is one of the most important automotive markets in Europe, with a strong presence of both domestic and foreign manufacturers. The automotive industry accounts for more than 20% of the country’s production volume and directly employs more than 120,000 people. The country produces more than 1.3 million passenger cars per year, which is a new car every 23 seconds (as of 2017).1

The aftermarket segment, which includes the sales and services of spare parts, tires, lubricants, batteries, and accessories, is also a vital part of the automotive industry. The size of the Czech Spare Parts market is around 1.2 billion EUR per year.

The Czech Republic automotive aftermarket market is expected to witness a growth in the coming years, owing to the increasing demand for quality and affordable products and services, the rising adoption of advanced technologies, and the growing awareness among consumers about the benefits of regular maintenance and repair of their vehicles.2

Czech Republic’s Automotive Aftermarket Market Overview

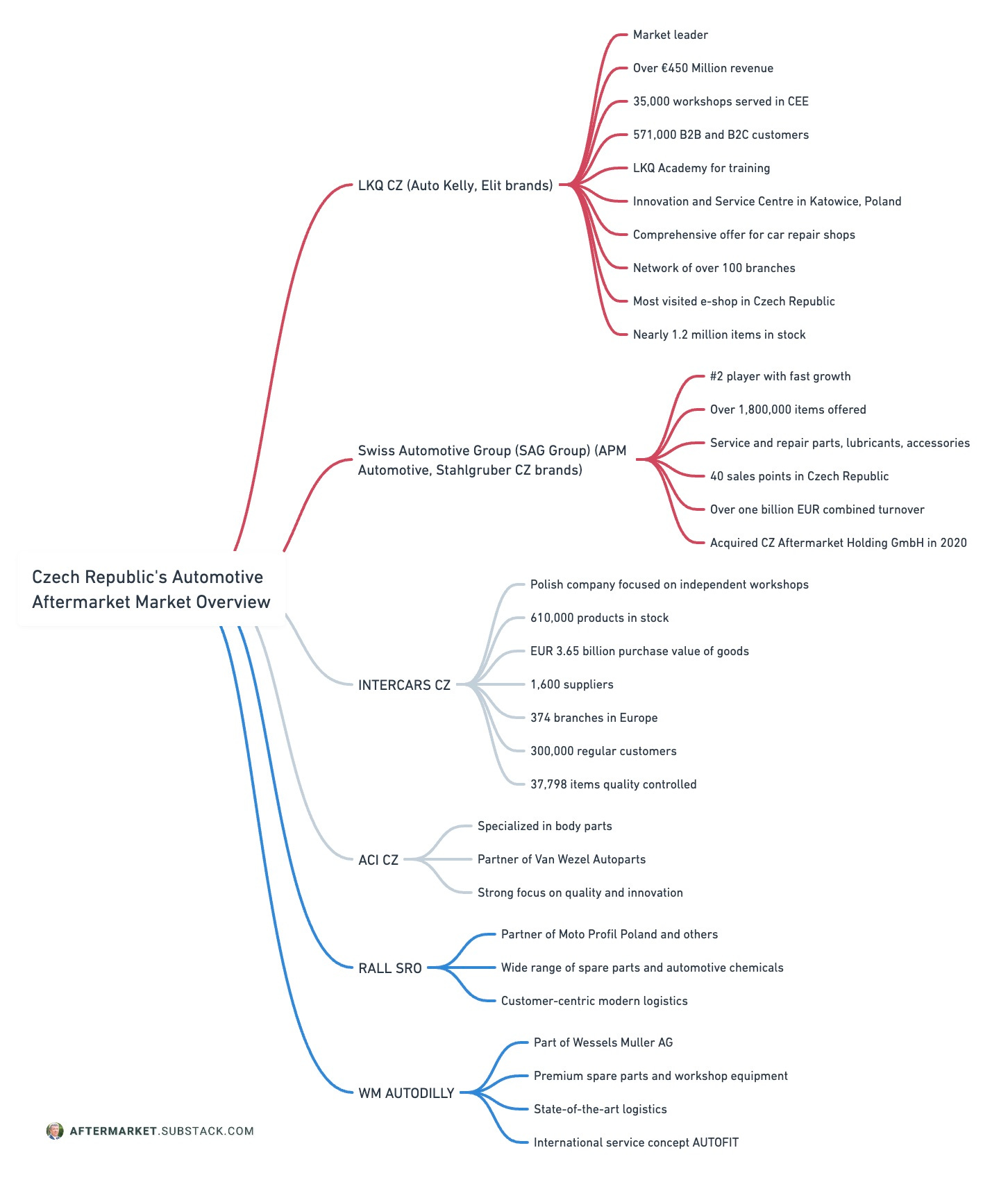

The Czech automotive aftermarket for spare parts and accessories is a mature, stable market dominated by the local subsidiaries of large European groups:

LKQ CZ (Auto Kelly, Elit brands) - Market leader with over €450 Million revenue

Swiss Automotive Group (SAG Group) (APM Automotive, Stahlgruber CZ brands) - #2 player with fast growth after acquisitions

Inter Cars CZ - Polish company focused on independent workshops, #3 player

Other players:

ACI - Specialized local player in body parts

RALL (Moto Profil Poland partner)

WM AUTODILLY - (Wessels Muller AG)

Titi’s take

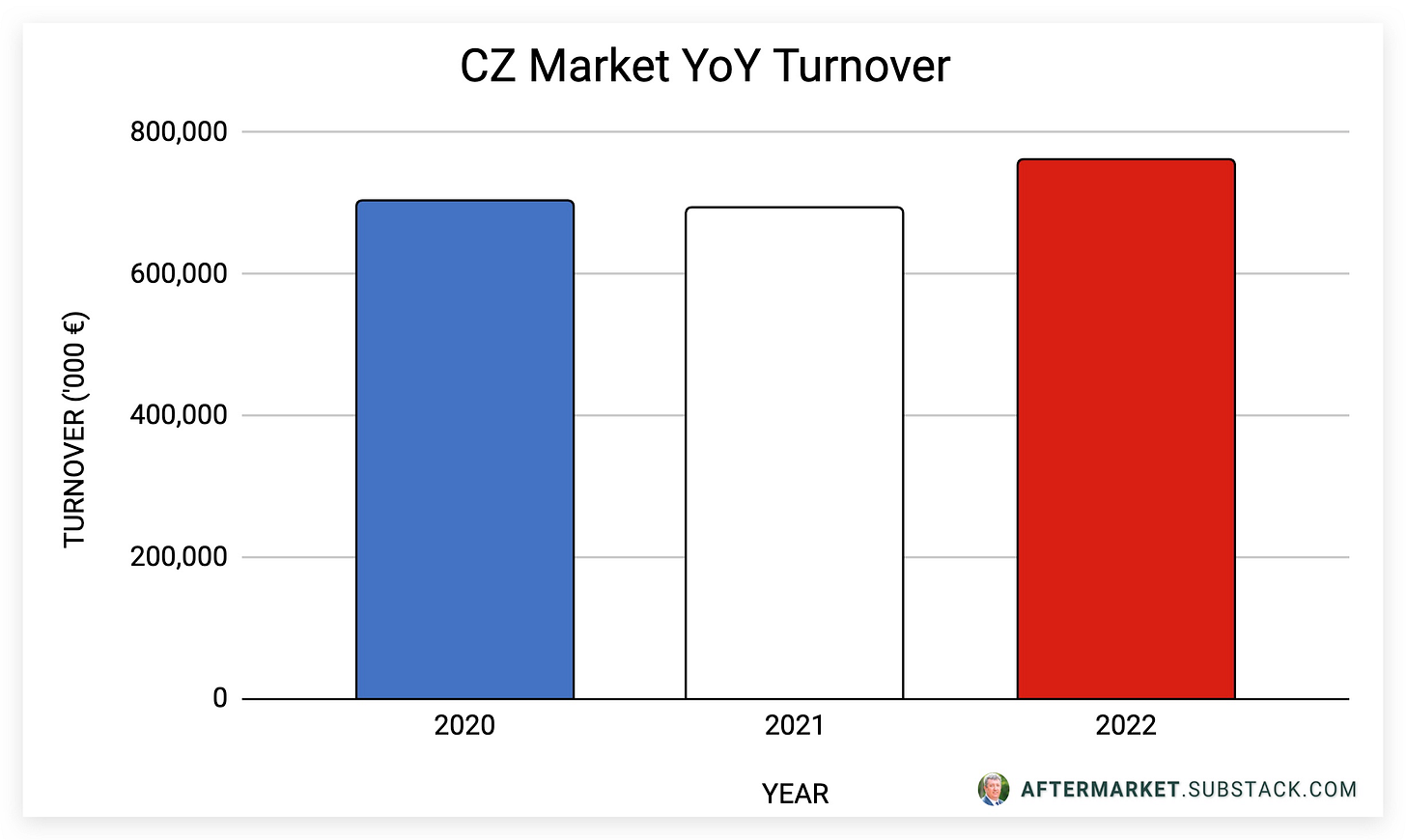

On a high-level, the aftermarket in Czech Republic proves to be very balanced, with a very competitive landscape. Market growth rarely exceeds 10%, but this offers a great potential for strong profit margins. I noticed that top players are investing heavily in logistics and supply chain infrastructure to enable fast, responsive delivery. While e-commerce is on the rise, traditional distribution still dominates this market.

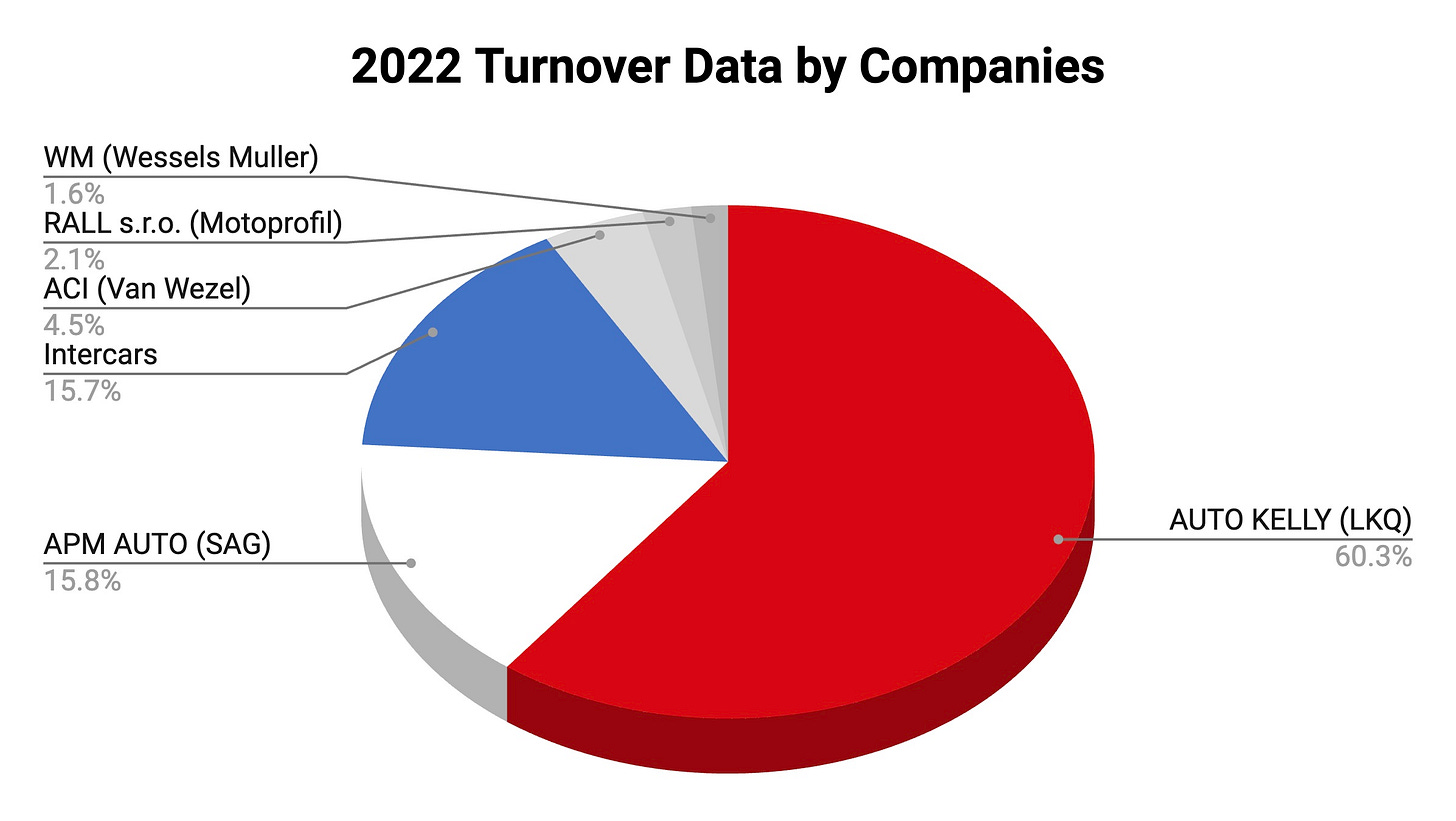

As shown above, the structure of the CZ market is:

Auto Kelly - LKQ Group (~ 60%)

APM Automotive - SAG Group (~15%)

INTERCARS CZ (~15%)

ACI CZ - Van Wezel NL Group (~4.5%)

RALL sro - MOTO PROFIL PL Group (~2.1%)

WM AUTODILLY - WESSELS MULLER DE Group (~1.6%)

In the following section, let’s zoom in on each of these players in the Czech’s market. I will dedicate more attention to the top 3 wholesalers, as they account for over 90% of the aftermarket market by turnover. Then we will brush over the other 3 smaller wholesalers and then end with my interpretation of the market.

TOP 3 Wholesalers in Czech Republic

LKQ CZ

LKQ CEE is made up of Central and Eastern European countries: Bosnia & Herzegovina, Czech Republic, Hungary, Poland, Romania, Slovakia, Slovenia and Ukraine: 8 countries, 10 different languages and 6 currencies.

All of these were successfully integrated into one company, when LKQ Europe took over RHIAG group in 2016, that included most of today’s LKQ companies in the CEE region. I unpacked the story of LKQ Europe in this article:

LKQ CEE operates a professional training platform in the region through the LKQ Academy in Prague and other cities, which offers expert online and offline training courses covering complete vehicle care and repair, including the proper management of garages.

LKQ CEE also has a state-of-the-art Innovation and Service Centre located in Katowice, Poland, that acts as a catalyst for the company’s innovation and digitalization strategy.

LKQ CZ s.r.o., the largest domestic supplier of auto-moto spare parts and accessories, is has been operating in the Czech’s auto parts market since 1992, originally under the ELIT brand. It sells spare parts and car accessories for passenger cars, light commercial vehicles and trucks, and also offers a comprehensive offer for the equipment of car repair shops, paint shops and garage equipment, including services and training. It covers networks of partner car repair shops and provides service for fleet customers. It also offers a range for retail customers, including e-bikes, scooters and hobby and leisure equipment.

“In 2021, LKQ completed the process of gradual merger:

Auto Kelly and ELIT became LKQ CZ.”

(Source)

LKQ CZ s.r.o. offers:

Nearly 1.2 million SKUs

A network of 102 branches with goods delivered up to six times a day

Comprehensive offer of car service equipment and garage equipment, including services and training

More than 300 contracted services in the network Auto Kelly Autoservis and ELIT partner

The most visited e-shop with spare parts and accessories in the Czech Republic

Auto parts from more than 500 brand manufacturers

Online technical and service data

Own training and demonstration center

Car fleet management through Car Fleet Service

Service Profi Garage - a modern online tool for managing car service orders and communicating with their customers

A loyalty program and service My Garage

Titi’s take

LKQ dominates the Czech market not only by turnover but also by its history of almost 30 years. LKQ only relied on the Auto Kelly brand for the local market, whereas the ELIT brand was used in other countries in the Central and Eastern Europe region.

Auto Kelly had minor attempts to enter other markets, but those initiatives were quickly blocked by their colleagues from the export company "ELIT" (Romania, Hungary). With over 450 million EUR turnover and over 60% of the market, LKQ CZ is by far the most developed distribution company in the Czech Republic.

Swiss Automotive Group (abbr. SAG)

SAG is a new brand of auto parts supplier in the Czech aftermarket market, which continues the long-standing tradition of APM Automotive and STAHLGRUBER CZ.3

With an assortment of more than 1,800,000 items, Swiss Automotive Group is one of the European market leaders in spare parts for cars and commercial vehicles as well as motorcycles. In addition to service and repair parts, the offer also includes lubricants, chemicals, accessories, workshop equipment and consumables. I wrote extensively about Swiss Automotive Group here:

“Our priority is above-standard customer care, quality services and easy accessibility. This is ensured by an extensive network of sales representatives and forty sales points throughout the Czech Republic, supplemented by a system of regular deliveries of goods. Customers can also benefit from service concepts and a multi-level technical training system.”

Public statement by SAG CZ

Swiss Automotive Group AG (SAG) was founded in mid-2009 by the merger of two successful Swiss family companies in the automotive repair industry. The merger of Derendinger AG and Métraux Services SA created a strong business group that suddenly became one of the largest players on the European aftermarket. Both brands with their branch network and independent presentation have been preserved.

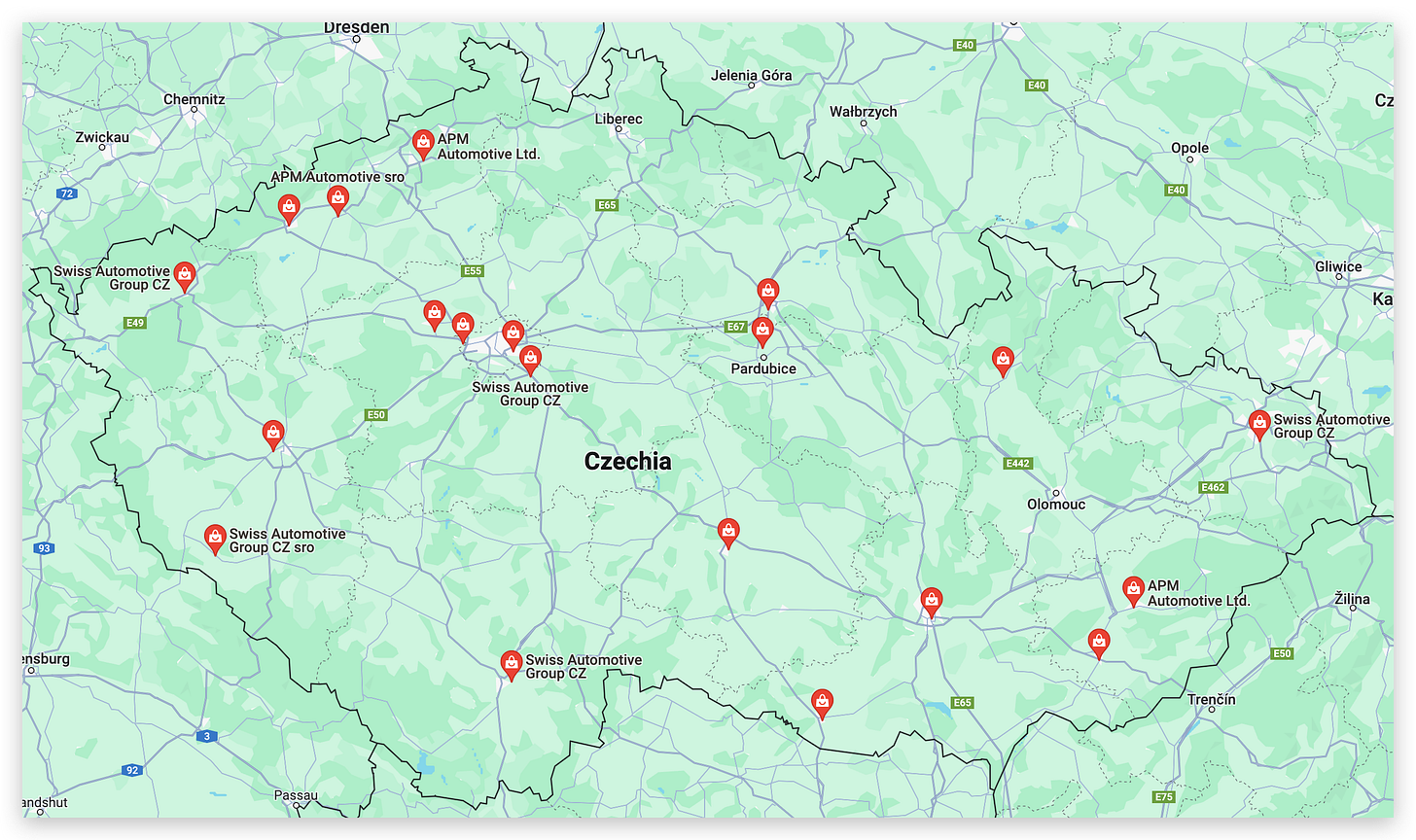

SAG headquartered in Cham, Switzerland, acquired all shares in CZ Aftermarket Holding GmbH from the Stahlgruber Group on January 8, 2020. The acquired company was founded in 2014 by Stahlgruber and Ernst Markmiller GmbH to combine their Czech subsidiaries (STAHLGRUBER CZ s.r.o. and APM Automotive s.r.o.) in a joint venture. Previously the Stahlgruber Group held 51.8 % and Markmiller 48.2 % of the shares. As part of the transaction, the shares have now been combined at SAG, although the merger is still subject to approval by the antitrust authorities.

SAG offers:

Auto parts, accessories and accessories for cars and commercial vehicles

OE parts for the most common vehicle brands on the Czech market

Spare parts and accessories for motorcycles

Service equipment, diagnostics

Equipment for tire service, air conditioning service, etc.

The CONNECT online catalog

40 points of sale throughout the Czech Republic and its own car service

Service concepts and technical training

Titi’s take

Swiss Automotive Group (SAG) entered this market shyly, trying first on its own. It then benefited from the forced sale by LKQ of the APM distributor and the Stahlgruber branches. SAG quickly acquired them and thus established a sufficiently strong "bridgehead" for further development, with sales increases that reached 80% YoY.

Logistics development will positively influence these increases, with the logistics warehouses under construction in Pressath DE and Budapest HU being strategically located.

INTER CARS CZ

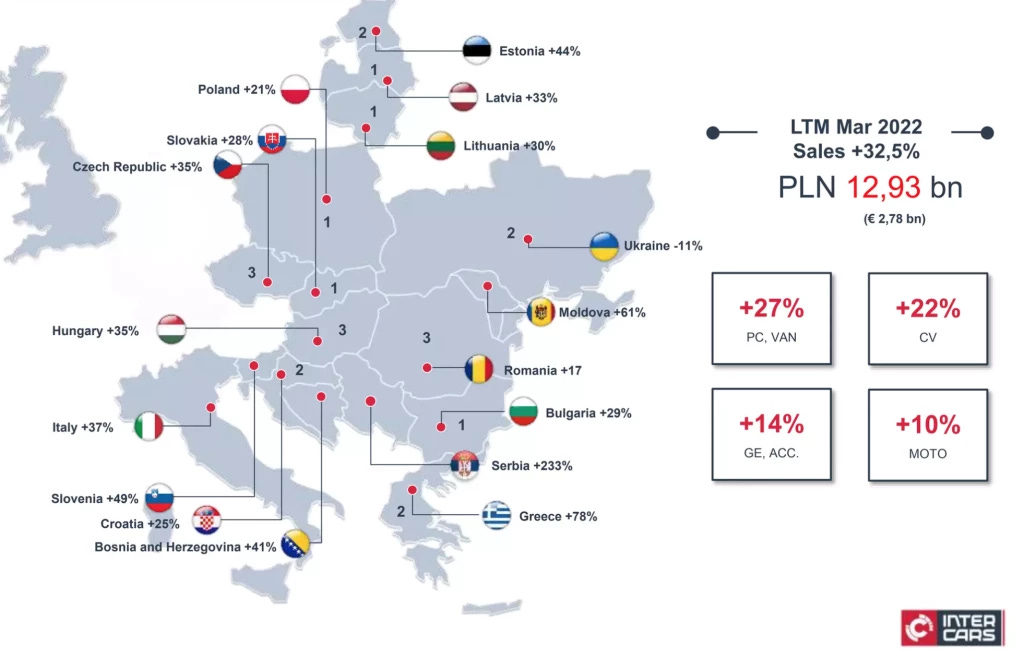

Inter Cars CZ has been a prominent presence in the Czech market since 2004 where it currently holds the #3rd place by turnover numbers. Over the years, Inter Cars has ascended to become one of the leading supplier of spare parts in Central and Eastern Europe, marking significant milestones in its journey.

Adhering to the motto "The way to higher standards" Inter Cars is committed to elevating the standard of independent car repair. Through initiatives like the Q-SERVICE network, the company strives to offer motorists quality care at affordable prices, collaborating with top global manufacturers.

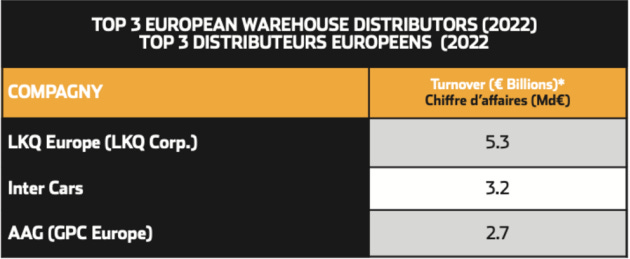

Inter Cars has been fueled by a franchise-based business model outside Poland and significant logistical investments since its inception in the 1990s. Expanding its reach, today Inter Cars operates in 21 countries, boasting 11 warehouses in Poland, 10 in neighboring countries, and 600 owned sites, including 240 in Poland and 300 integrated garages. This extensive network, enhanced by digitalization, has been a key factor in its market dominance. I wrote extensively about Inter Cars in the following article:

Their 2022 figures are:

610,000 SKUs

EUR 3.65 billion purchase value of goods

1,600 suppliers 244 branches in Poland

374 in Europe

300,000 regular customers

37,798 items subjected to quality control in the Intermeko laboratory

4,176 training participants for customers in Poland

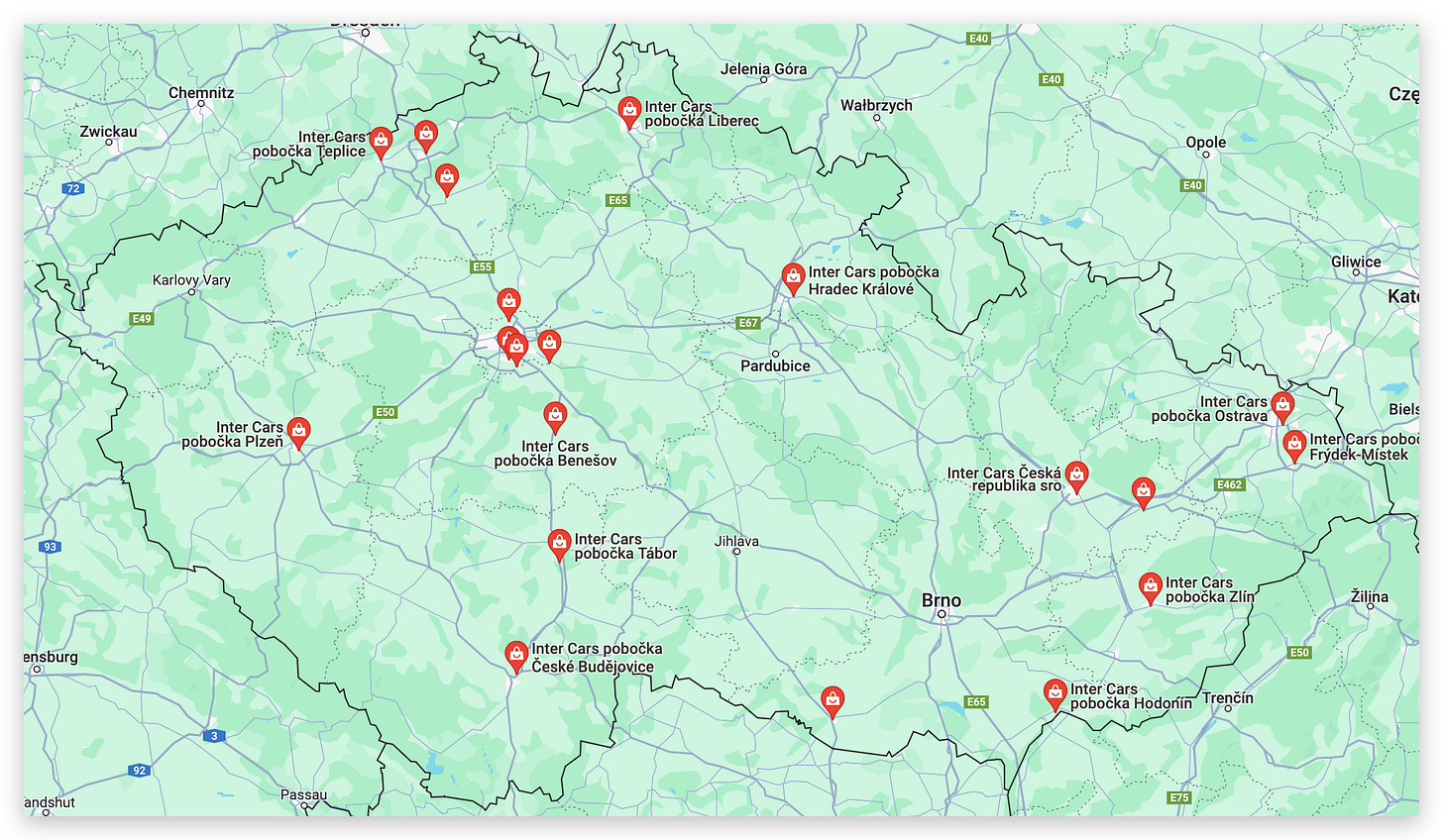

The data available for Intercars CZ is limited, but cross-referencing various sources, I gathered that after 20 years in Czechia, Intercars CZ operates4:

1 Central Warehouse in the outskirts of Prague

7,559 square meters

2 Regional Warehouses

One in the far Eastern side of the country - Lipník nad Bečvou

One in the Southern part - Brno

Over 36 regional franchises (branches)

Inter Cars CZ had a turnover of almost 120M in 2022, with a healthy pace of about 20% increase YoY between 2020 and 2022.

Titi’s take

Inter Cars Poland entered the Czech Republic’s market in 2004 and has an average development, between LKQ and SAG, with increases of up to 30% in turnover. And in their case, logistics was a strong pillar, with warehouses in southern Poland and the modern warehouse in Prague dedicated to the Czech market.

Other wholesalers in Czech Republic

ACI

Established in 1994, ACI starts off their journey by becoming an exclusive representative of the Belgian company Van Wezel Autoparts.

Van Wezel Autoparts (part of the Unipart Group of Companies and associated supplier of Temot International and ATR) is one of the leading players in Europe in manufacturing and distribution of automotive body and cooling parts due to a constant focus on quality and innovation.

From the headquarters in Tienen (Belgium), the 2 additional warehouses in Belgium and the premises in Germany, Austria, the Czech Republic, Holland and Italy, Van Wezel supplies its professional customers worldwide.

With an experience of over 65 years, Van Wezel actually offers a range of strong and reliable brands: Equipart (bodyparts), Hagus (mirrors), International Radiators (engine cooling) and HS (Hubert Schlieckmann) (various parts at OE standards).

These own brands permit Van Wezel to make the difference towards low cost products which only focus on price (and not on quality).

The customer can trust that products labeled with the Van Wezel brands were subjected to the most demanding quality, mounting and safety tests. These products are equivalent to OE products in all areas, except for one: the price!5

Titi’s take

The ACI SRO company is a special one, specialized in the distribution of body components, a collaborator of Van Wezel NL. Only in Hungary will you find another company that in trying to offer a complete range of bodywork it reached this size and not have major financial problems on the way. In the case of body parts, the slow rotation of the stock and the competition of car dismantling companies make the business very difficult to support.

Autodily Rall SRO

Rall S.R.O. is an enterprise in Czech Republic, with the main office in Ostrava. The company operates in the Department Stores industry. It was first established on October 30, 1992. Rall is a partner of:

PROFIAUTO

Moto-Profil Poland

POLCAR Poland

LIQUI MOLY Germany

Their services include:

A wide range of high-quality spare parts, accessories, and automotive chemicals.

Customer-centric modern logistics.

Daily delivery of products to your specified location.

Detailed and up-to-date information about products, technical advancements, and trends, straight from the manufacturers.

A commitment to long-term partnerships.

We ensure that we do not compete with our customers.

Tailoring our offerings to meet each customer's unique preferences.

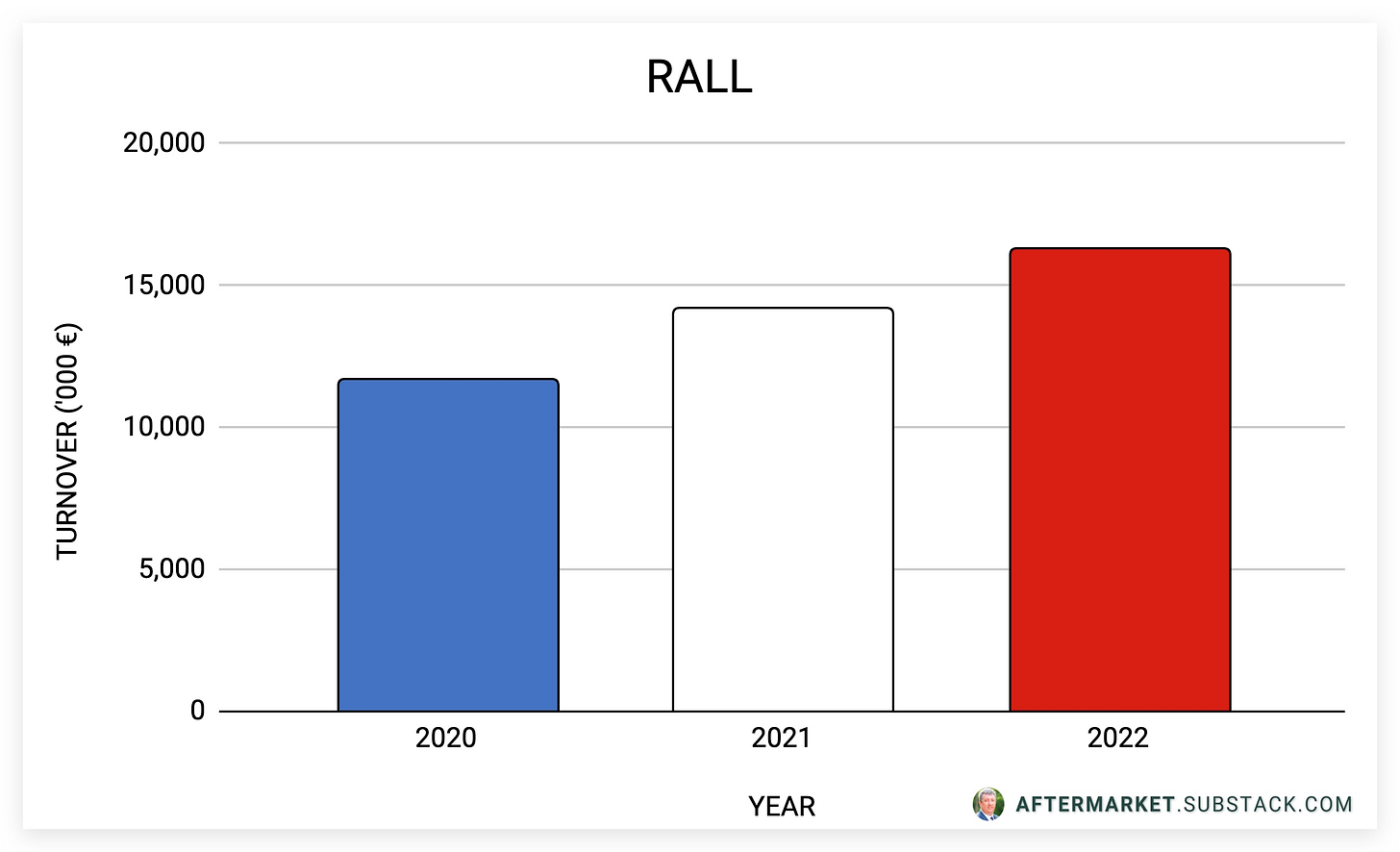

Even though it has a smaller market share than the big players, RALL’s turnover is growing at a healthy pace of 10-15% YoY, right at the average for CZ Market.

WM AUTODILY SRO

WM SE, the parent company of WM Autodíly, is one of the leading companies in the field of trade in automotive parts, accessories, tools, and car service equipment in Europe. WM has more than 200 sales points in Germany, Austria, the Czech Republic, the Netherlands, and the USA. WE SE destock approximately 45 million items a year and deliver shipments Just-in-Time to the customers, i.e. car repair shops, up to 5 times a day. WM portfolio includes a perfect logistics solution for the supply of spare parts from well-known global manufacturers as well as high-quality own brands that show a unique ratio of utility value and price. WM strength is also the sale, training and service of the necessary workshop equipment that customers need when repairing cars.

In Czech Republic WM SE have one warehouse.

Premium spare parts from well-known brand manufacturers

State-of-the-art logistics combined with maximum availability.

AUTOFIT international service concept

Own brands of auto parts with a unique price/use value ratio

Equipment and planning of workshops and garages

Titi’s take:

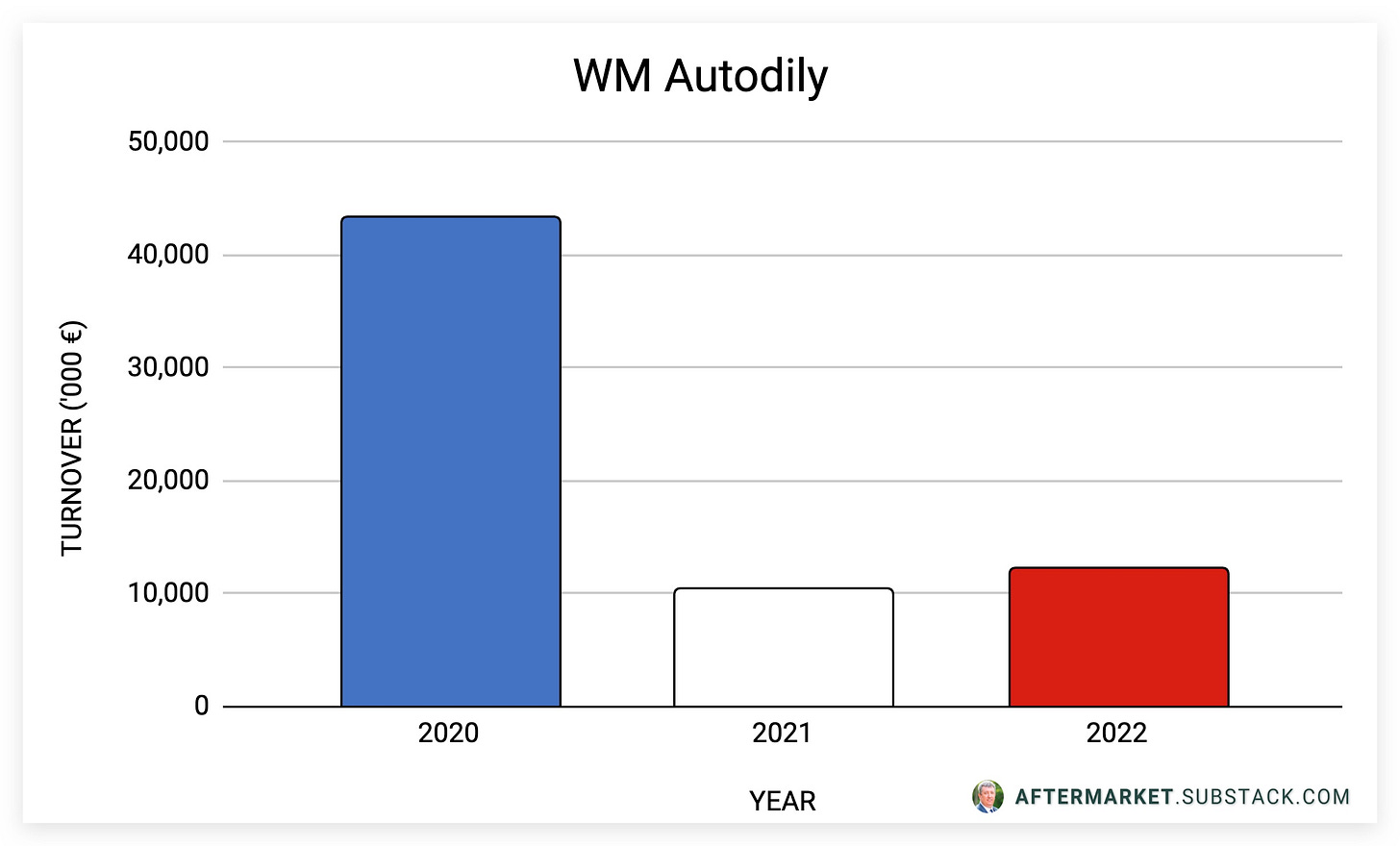

The other companies operating in the Czech market are collaborators or subsidiaries of foreign companies. RALL collaborates with MOTO PROFIL Poland and WM Autodilly is a subsidiary (with only one warehouse) of Wessel Muller DE (the warehouse was inherited via METEOR- TROST- WM through successive acquisitions).

In 2021, WM Autodily went through a major restructuring, which led to closing of all their warehouses except one in Prague. This change is reflected in its big drop in turnover in 2021. 2022 shows a gradual improvement, but there is still a long way until topping the previous numbers.

While on the topic, I must mention that all the Polish companies are working on expanding their delivery routes in the surrounding countries, the Czech Republic being not only close but also with a market that demands parts, services and good purchase prices (in order to realize the margin). The companies that come to mind are: Auto Partner SA, Moto Profil, and POLCAR.

Czech Republic’s aftermarket market outlook

Titi’s take

With a turnover of almost one billion euros in auto parts, the aftermarket market in the Czech Republic is dominated by the subsidiaries of the big European groups: LKQ, SAG, INTERCARS, WESSELS MULLER and MOTOPROFIL. This shows that Czech’s aftermarket is a mature, very balanced, and with clear rules market, that proves to be very difficult for a new entry to approach. Over the course of the past 10 years the annual growth of this market never exceeded 10% YoY increase, but this offers the possibility of creating a very good profit margin.

While each of the above companies has its strengths, with the competition being so fierce, it really comes down on the management of LKQ CEE to slow down the conquest of the market by the new entrants. My hope is that the management will be more active in Czechia than in other countries (especially Romania) and not lose their market share year after year, still using the pandemic and post-pandemic recovery as scapegoats. Contrary to what LKQ CEE declared6 about the massive decreases in turnover in the region, the aftermarket did not suffer that big of a contraction.

Companies like Swiss Automotive Group (SAG) and Intercars know how to acquire market share: first logistics, then aggressive marketing and which leads to extraordinary results. All things considered, the Czech automotive aftermarket is not set to see any major shakeups in 2024.

Thank you for reading and supporting my work! I use all my free time to put together this information and it means the world to me that people like you find it useful!

![[Company Overview] LKQ Europe](https://substackcdn.com/image/fetch/$s_!D1tC!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6c9eeafc-8f82-4d58-bc13-1f12e10fa039_2408x1236.jpeg)

![[Company Overview] Swiss Automotive Group](https://substackcdn.com/image/fetch/$s_!egqZ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F02c6b114-5d36-4d4c-84fd-43cd94d828e8_1600x1009.jpeg)

![[Company Overview] Inter Cars: Accelerating Success](https://substackcdn.com/image/fetch/$s_!P0hi!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff8a64f87-4b90-435f-8a00-dd83fd69b424_1200x600.png)