Romania's Aftermarket Car Industry in 2024

The Updated Top 10 Romanian Wholesale Players Based on Raw Data

Hello friends,

Today I’m very excited to bring you an updated overview of the Romanian Automotive Aftermarket for 2024:

At the bottom, you’ll find a table with the exact public financial figures of the companies operating in Romania’s Aftermarket sector.

I’ll briefly point out the few changes in the ranking of these firms, and then I’ll have the honesty to analyze what I predicted wrong — and what I got right — in last year’s article (which I highly recommend reading as a primer to this one).

Now, let’s get into it:

First glance? We have to admit it — AD AUTO TOTAL pulled off a phenomenal boost, surpassing all competitors en fanfare. Expanding their product range, spot-on marketing, excellent relationships with key clients at the management level — all of this led to this major success. Two consecutive years with revenue growth over 20%, and two years in a row with a 20% profit margin… that’s a major success! Congratulations!

All this in a market that grew by 13% two years ago, and by 10% last year...

Now, let me own up to a mistake in evaluating this company: I said “AD AUTO TOTAL is prepping for sale, hence the significant improvement in figures.”

Wrong. AD AUTO TOTAL wasn’t sold — but they sure are “keeping their stroke rate up,” as we say in rowing.

The big news? AUTONET IMPORT held steady these years, same numbers — no more, no less.

Meanwhile, the CEO of the parent company, SWISS AUTOMOTIVE GROUP, Mr. Pifaretti, sold his stake to the industrial conglomerate LAFARGE, owner of the HOLCIM brand in Romania. If you want to read more about Swiss Automotive Group, see my previous article on it:

There you have it — how the experts’ predictions get wiped out by market reality, which ultimately dictates the evolution of the players.

Even more interesting: AUTONET IMPORT loses second place in the ranking of Romanian auto parts distributors to Inter Cars Romania. (See here the Company Overview).

Despite growing by nearly 8%, which is below the market average of 10%, Inter Cars Romania leverages its franchise system well. The “ants” in the territory — if they get the right stock and meet the conditions — can perform very well.

There’s been a relaxation of Inter Cars Romania’s credit conditions — we just hope this doesn’t financially strain the franchises in the field. Because when collection time comes, loosening the conditions (like scrapping those old invoice assignments over 60 days) won’t hurt Inter Cars Romania, but the franchises out there… they’ll feel it. At home.

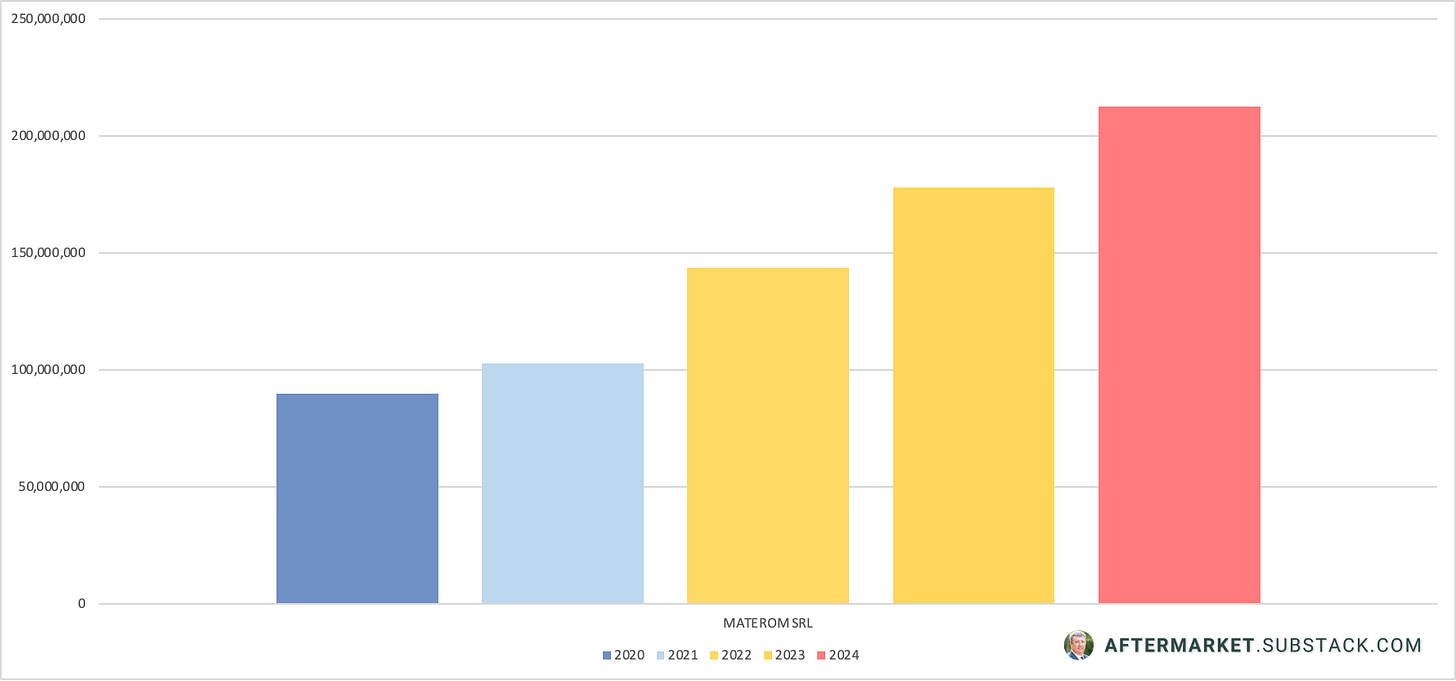

Next up, MATEROM, with a spectacular revenue increase comparable to the market leader — over 20% growth for two consecutive years.

In my opinion, fourth place is a very demanding spot. And it’s not SAP that brought them here, nor their investment in people (just look at any job board — Materom always has job ads because of the high migration of their workforce to other companies).

The growth actually came from their OEM business — a stable, wholesale operation with dedicated clientele.

I don’t want to get angry calls or threats to “change my opinion,” but this is my view as a specialist with over 25 years of experience in Romania’s Aftermarket.

I hope their back-end processes are solid enough to keep up with such year-over-year growth. Otherwise, we’ll soon have another company up for sale in Romania.

Business is business, right?

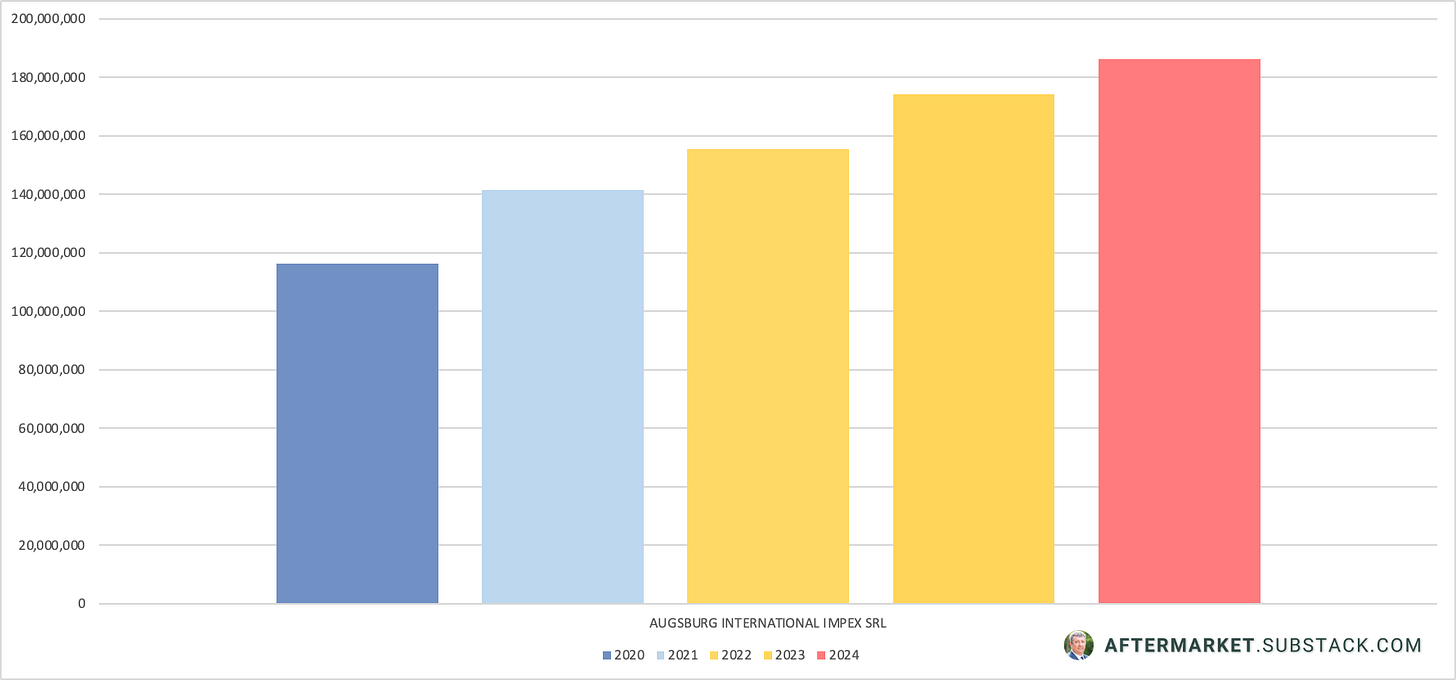

AUGSBURG INTERNATIONAL is losing momentum, just like its majority shareholder, AUTONET IMPORT.

Still, I believe it’s a company that retains its backbone, shaped by the former owners.

The fact that the internal processes were set up properly, and software investments were wisely managed, means this business still runs smoothly today. They have dedicated clients, a well-trained, well-positioned sales force, and efficient logistics.

In the second half of the Romanian ranking, we have CONEX DISTRIBUTION.

The results show a stable company growing healthily and consistently both in revenue and net profit, year after year.

The performer? BARDI AUTO — a company I’ve been praising for taking care of its people.

And now we see the results: responsible management, employees who feel appreciated — and voilà — they pull off a surprise and surpass their “country colleague,” UNIX AUTO, in the top 10 Romanian auto parts distributors.

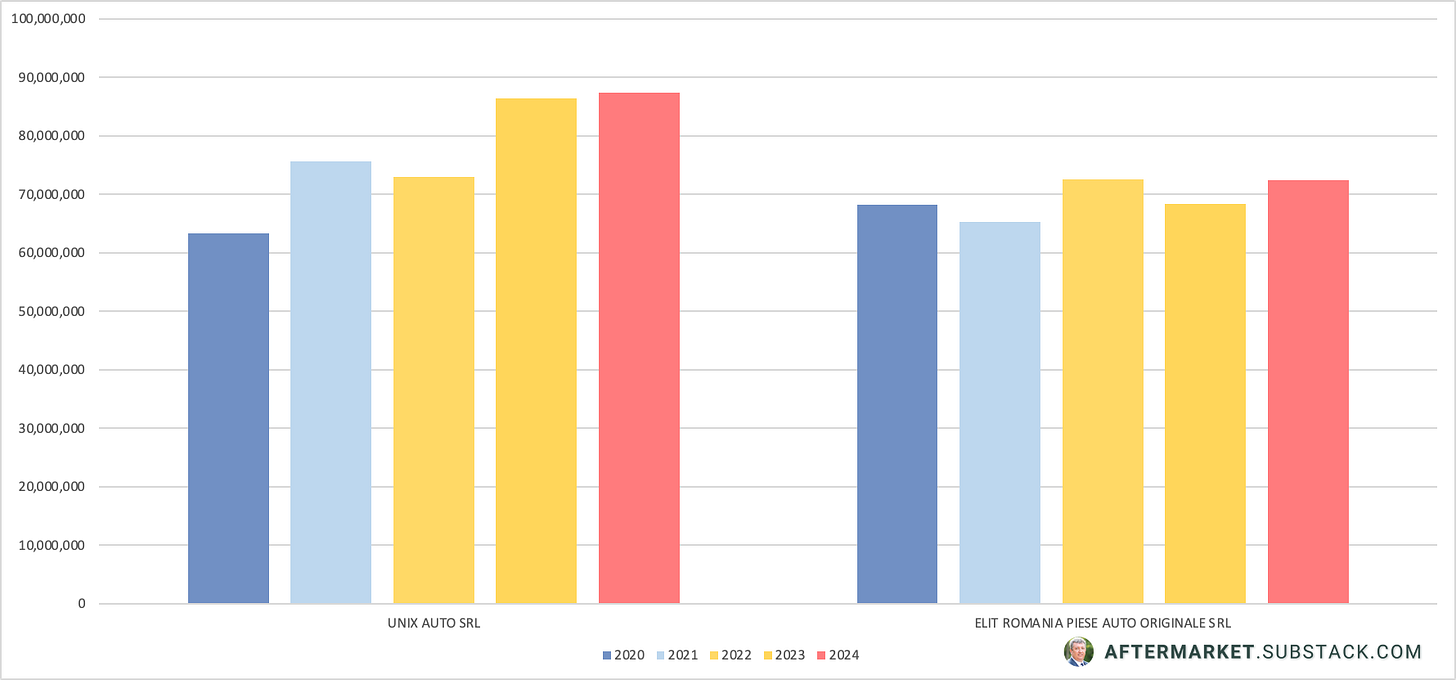

The ranking wraps up with two totally different companies that have one thing in common: UNIX AUTO and ELIT PAO.

Both are multinationals, both perform well in other markets, but both made the same mistake — they overlooked the most important asset: their people.

When you treat your people as unimportant, telling everyone the system matters, not the employees, this is where you end up — bottom of the ranking.

The difference between the two?

UNIX AUTO has very good internal systems applied in Romania — the problem is how they treat their employees. (Just look at the endless job ads — nobody wants to work in a company run the same way, by the same management, for years...)

At ELIT, I believe the problem runs deeper — as I’ve detailed before in my articles.

In every branch, people do whatever they want to make their money. And it’s not just happening in Romania.

Conclusion

There are no huge surprises in Romania’s Aftermarket auto parts market. But the small details paint the full picture. The evolution of players shows how good — or bad — their policies have been over the years.

We’re heading into an economic crisis.

Excessive taxation of businesses to fund a bloated, inefficient state apparatus will lead to the closure of small businesses and an economic recession.

And since I don’t believe anything in this economy can be fixed through overtaxation, only by reducing state expenses, I’m considering reorienting myself — maybe even changing my work location.

Got suggestions? I’m all ears. Thanks!

![[Company Overview] Swiss Automotive Group](https://substackcdn.com/image/fetch/$s_!egqZ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F02c6b114-5d36-4d4c-84fd-43cd94d828e8_1600x1009.jpeg)

Utila analiza. Totusi ceva nu se leaga. Piata nu a crescut cu 10% in 2024. Daca e sa luam doar distribuitorii mentionati in articol, cresterea pietei a fost de doar vreo 6%. Similar nici in 2023 piata nu a crescut cu mai mult de 10%.