Poland Automotive Aftermarket in 2024

A comprehensive overview of the market and top wholesalers

Poland is a country that I have always seen as a leader in Central and Eastern Europe in terms of the auto parts market. A large, well-structured market, with many players eager for market share and profit. It proved to us that it is a free market by the multiple entrances/exits from the market and by the changes in the top distribution companies. At this moment, the "tone" is set by Poland for this region. If you want to see how good you are, test your luck in Poland! Success!

Poland’s market overview

After years of turmoil, the automotive industry is still developing in the region. Over recent months, supply chains have stabilized to some extent, and actions leading to their shortening are slowly allowing for the diversification of supply sources. Enterprises have also adapted to the ongoing war in Ukraine, factoring its effects into their own forecasts and plans. Despite constantly high inflation and rising costs of running a business, investment outlays are not decreasing, but on the contrary - they are increasing.

During my research, I came across this wonderful summary of the Polish aftermarket by Tomasz Bęben, president of the Association of Distributors and Manufacturers Automotive Parts1:

“With a staggering €30 billion invested annually, the automotive sector is the largest private investor in research and development in the EU. The automotive industry is undergoing a twin transformation - ecological and digital. Both of these areas require faster, more advanced and diverse solutions. We have entered the decade of the software-defined vehicle. Soon, software will become a differentiator on the basis of which people will decide whether to buy or refrain from buying a given car. Automotive parts manufacturers, with around nine thousand, are the leader in Europe in terms of new patents filed each year. They are the ones who, investing tens of billions of euros in research and development every year, play a key role in modernizing and adapting the automotive industry to new global regulatory requirements and social challenges. As the automotive industry transforms, it is necessary to create an attractive business environment to establish the necessary conditions to achieve goals and enable innovation by adopting a diversity of technologies, which reduces our dependence and allows us to achieve climate neutrality faster and more effectively”

At a high level, here is a great overview of the major players in the Polish automotive aftermarket market, based on the latest data:

Now let’s begin going over each one of them, in order of their 2022 turnover data. For each, we will unpack their story, the most important points in their development, the groups they are a part of, their financial data and finally, my own opinion about them. Let’s begin!

1. INTER CARS SA

In Poland's Aftermarket parts distribution landscape, a few key companies stand out for their influence and dominance. Among these, Inter Cars is a noteworthy leader. It ranks as the third-largest Independent Aftermarket (IAM) distributor in Europe, trailing only behind LKQ Europe and GPC Europe. Inter Cars has been instrumental in shaping the aftermarket dynamics across Eastern Europe and has been a major driver of its growth.

Here is a list of the biggest shareholders of Inter Cars SA:

Inter Cars is recognized as the foremost distributor of spare parts for passenger vehicles, vans, and trucks in Central and Eastern Europe. Their range extends beyond just parts; it includes equipment for workshops, specifically tools for vehicle servicing and repair, as well as motorcycle parts and tuning components. Additionally, Inter Cars is involved in selling Ducati motorcycles, refurbishing car parts, and manufacturing trailers and semi-trailers. They also own a nationwide chain of car repair shops.

Inter Cars SA, by the numbers:

610,000 products in stock [SKUs]

EUR 3.65 billion purchase value of goods

1,600 suppliers 244 branches in Poland

374 in Europe

300,000 regular customers

37,798 items subjected to quality control in the Intermeko laboratory

4,176 training participants for customers in Poland

achieved a remarkable 24.9% increase in sales YoY2

Titi’s take

We all have to agree that the concept of franchise development was a brilliant idea for InterCars, both in Poland and throughout Europe. Based on the data that we have, I gather that there's currently a financial disagreement between the Warsaw Stock Exchange and the Inter Cars franchisees over profit distribution. If management doesn't resolve this issue and achieve a balance, the outlook isn't promising.

The main danger comes from Auto Partner SA, which is listed on the stock exchange like Inter Cars, but in the relationship with the franchise partners it is much more competitive. Auto Partner SA systematically bites into Inter Cars’ marketshare in Poland, but I believe it will soon target other Inter Cars subsidiaries as well.

Who are the winners here? The increased competition, the market as a whole, and finally the consumers, who benefit from services that are much improved, more efficient, and digital.

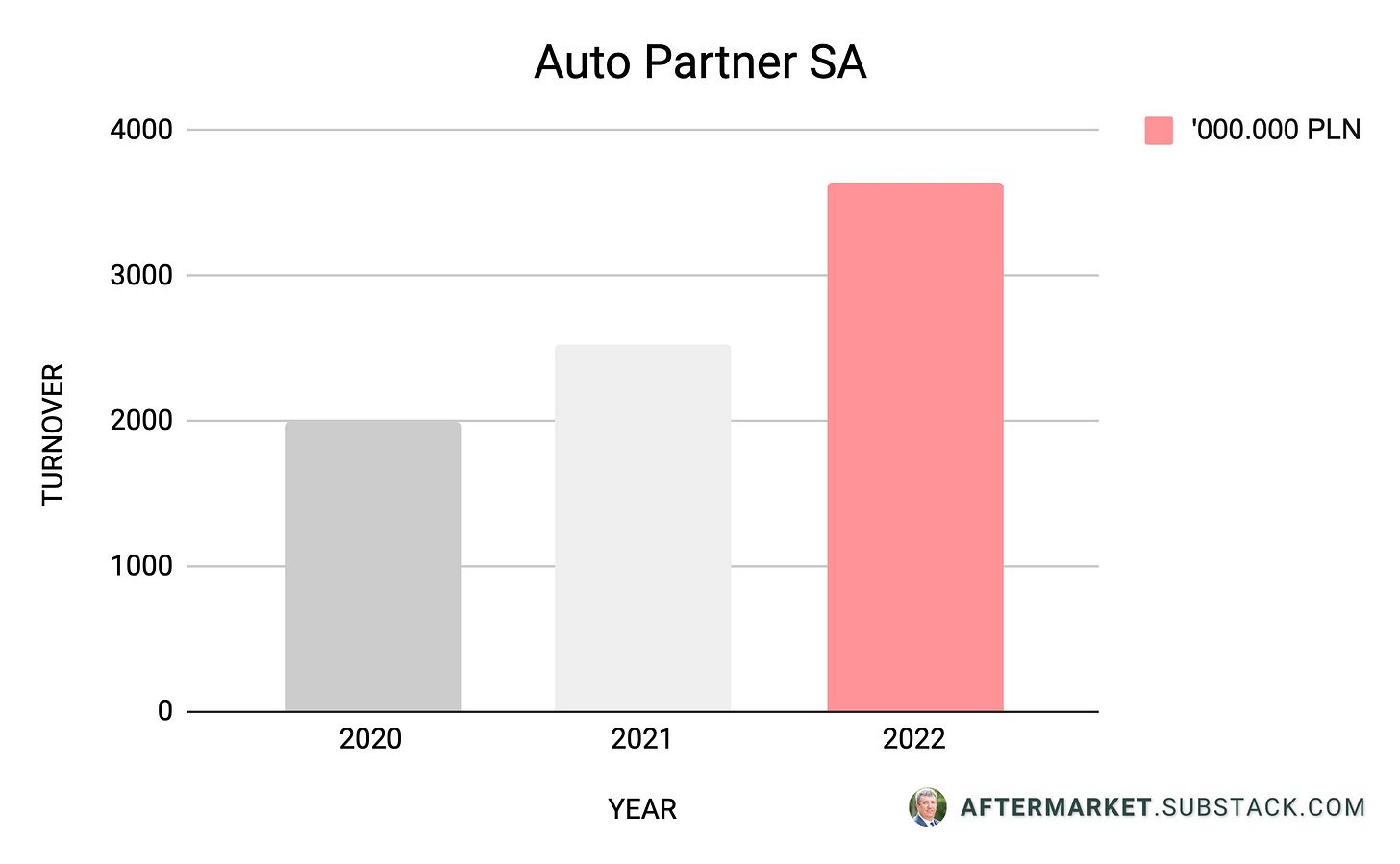

2. AUTO PARTNER SA

Founded in 1993, Auto Partner has established itself as a notable importer and distributor of spare parts for cars, vans, motorcycles, and workshop equipment. The company primarily functions as a platform for the sale and just-in-time delivery logistics of spare parts, catering chiefly to workshops and car dealerships.

Auto Partner Group has a broad reach across Europe, currently serving 30 international markets and collaborating with over 350 aftermarket spare parts suppliers, as well as OEM suppliers globally. Their product portfolio boasts an impressive range of over 250,000 references.

In 2022 and 2023, Auto Partner reported over 20% YoY increases in sales. Their growth can’t be explained only by a growing Polish aftermarket. The company is known for its direct deliveries into several other European countries.

Here is a list of their biggest shareholders:

With their extensive fleet of vehicles, Auto Partner is able to assure daily deliveries to customers throughout Europe and offers frequent delivery services in Poland, ranging from 3 to 5 times per day. A substantial portion of their inventory is consistently in transit, with delivery routes extending as far as Spain.

In recent years, Auto Partner has emerged as a significant player in the industry. The company estimates that cumulatively for the period from January to December 2023, the preliminary revenues of the Auto Partner Group will amount to PLN 3,649,001 thousand. PLN, which, compared to the same period of 2022, represents an increase of 28.73%. 3

Titi’s take

The young wolf of the pack, Auto Partner has won many bets in the Aftermarket sector; I consider them to be the Myth Busters of the aftermarket.

I worked with their management for a while, helping bring Auto Partner SA to Romania. I respect Mr. Alexander Gorecki (and even admired his passion for chess), but I believe the rest of the management at the time could have been more professional and accomplished more.

Focusing on the Polish market, Auto Partner is the winner. Their growth has been explosive: sales, profit, stock market capitalization, and logistics development. Many expected a financial implosion due to rapid growth, but the stock market favored Auto Partner, with capitalization providing the necessary funds to support the company. I say congratulations to them for their courage and clear vision to move forward on their chosen path.

Like all outsiders, I would recommend them financial caution and balanced growth, considering Poland versus other countries. I’m saying this because Inter Cars, as an example, wouldn't have survived without internationalizing the business and redistributing financial efforts to high-performing countries.

To run an international business, you must accept that you will approach each market differently, tailored to their specific needs. This adaptability leads to success! If a market demands inventory, supply it. If another one wants lower prices with fewer services, go for it!

I am happy to have collaborated with them, a serious company that made me a half-millionaire in euros for a day - but that’s a story for another day.

Word of advice: be willing to embrace diverse opinions; this will lead to your success.

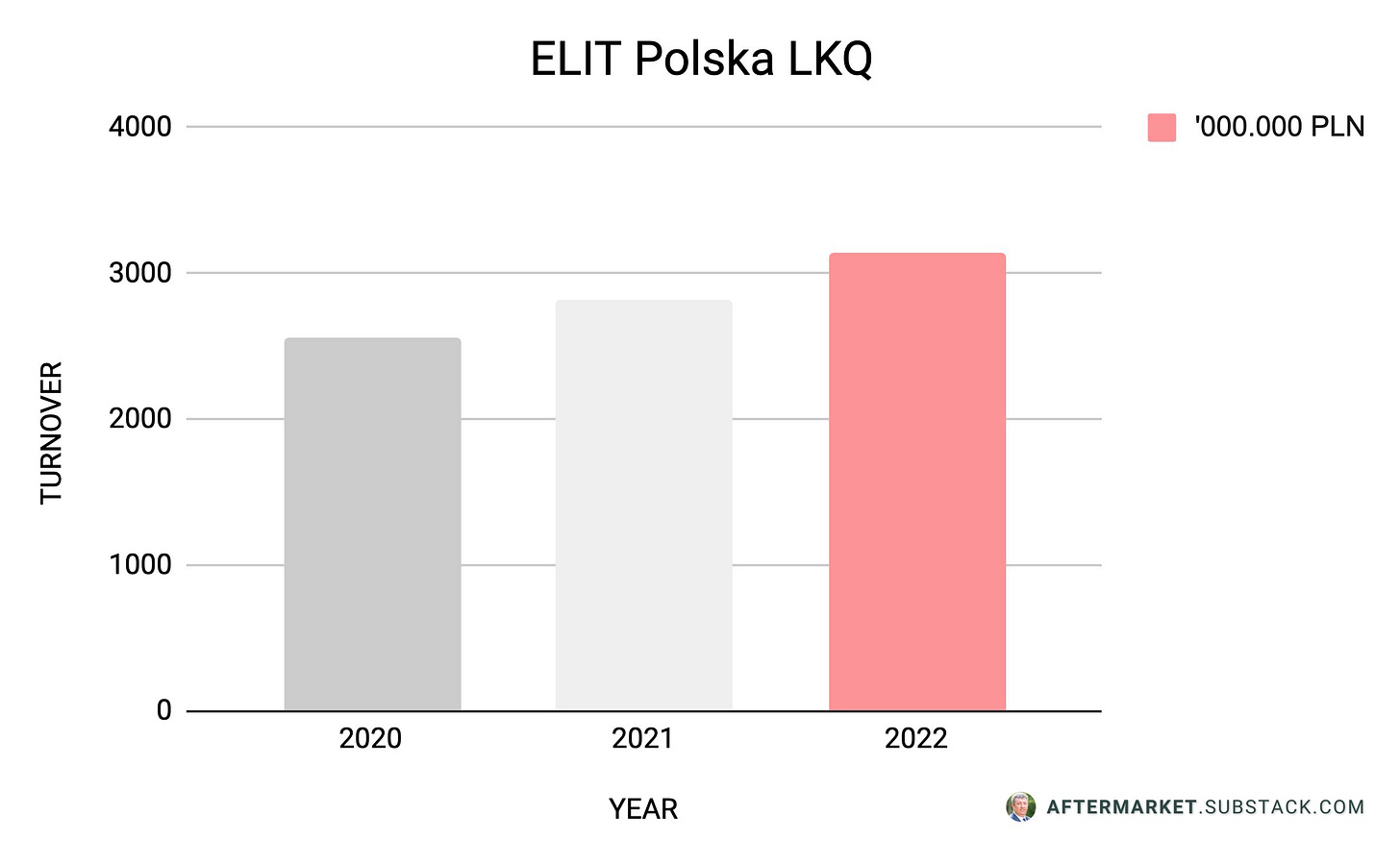

3. ELIT POLSKA LKQ

aSince its inception in 2011, LKQ Europe has significantly broadened its reach by acquiring over 80 unique companies across more than 20 European countries. These companies come with their own distinct operating systems, product lines, target markets, and organizational cultures. In 2019, to effectively integrate this diverse range of acquisitions, LKQ Europe initiated the "1 LKQ Europe Program". The goal of this program is to consolidate these various operations into a cohesive European entity, creating an efficient, international structure that leverages the company's extensive scale. The establishment of the LKQ Innovation and Service Center in Poland underline the company’s dedication to both integration and digital innovation.

Read more about LKQ Europe, its structure and financials, here:

About LKQ ELIT Polska

LKQ ELIT Polska, a prominent distributor of automotive parts, consumables, and workshop equipment in Poland, has been an integral part of LKQ Europe since 2017. The company is known for its professional service, appealing commercial conditions, rapid delivery, and market-competitive pricing. It operates 47 branches across Poland and maintains 2 warehouses in Kraków and Wrocław. Employing a total of 850 staff members, LKQ ELIT Polska serves 65 ELIT Partner workshops and boasts an extensive product portfolio with over 100,000 items. The company also offers a comprehensive range of services to its fleet customers.

With the investment in a new central warehouse near Cracow, LKQ ELIT Polska, as a European leader in the Automotive Aftermarket, is enhancing its competitive edge in local markets. This move is also part of its strategy to expand its logistics network across Europe, adhering to a "logistics without borders" philosophy.

Jan Dżaluk, COO of LKQ Central & Easter Europe (CEE) explains4 the reasons for building the new central warehouse:

“We want to meet the needs of our customers in Poland in the best possible way, so we continually strive to increase our logistics resources and improve the quality of deliveries. The launch of the new central warehouse is of strategic importance in the context of the further development of LKQ ELIT Polska and LKQ in the CEE region. Thanks to the investment in Modlniczka we will not only provide our customers with professional service according to global standards, but above all we invest in the future”

In the past 5 years, the German family business Hella, known for its involvement in both manufacturing and distribution, has undergone notable changes. Previously, Hella managed a distribution group, Nordic Forum, which included Hellanor in Norway, FTZ in Denmark, and Inter-Team in Poland. However, a strategic shift occurred with Hella divesting these components. FTZ and Inter-Team were sold to the Swedish Mekonomen Group, which is partially owned by the American LKQ Corporation, while Hellanor was acquired by the Aurelius Equity Opportunities fund.

This move signifies Hella's refocusing on its primary manufacturing business, moving away from the distribution sector. With LKQ's presence in Poland, now indirectly including Inter-Team, the competitive landscape is changing. Inter Cars, which used to collaborate with Mekonomen Group, may now find itself in a more competitive scenario with entities much larger than itself, signaling a potential shift in market dynamics.

Titi’s take

Like any American-origin business, ELIT Poland is and will be focused on profit making. They bought the ADI network for 100 million EUR, but I don't see real development happening there.

From what I gather, Polish nationalism and the resentment towards multinationals were not taken into account during the acquisition process. The Polish market is too vibrant for a self-sufficient and cumbersome LKQ. I wouldn't be surprised if there's an exit from the Polish market for this marketable brand, ELIT.

While on the topic, please remember that ADI, after exiting the Polish market through its sale to ELIT, re-entered by incorporating the player GORDON into its network, who has long yearned for regional development in Eastern Europe.

4. GROUPAUTO POLSKA S.p.a

Established in 1977, GROUPAUTO International unites more than 110 independent automotive parts distributors throughout Europe. The network covers 29 countries, collectively accounting for an impressive €9 billion in annual sales.

As a cooperative focused on purchasing, GROUPAUTO capitalizes on the collective buying strength of its members to secure more favorable terms, discounts, and service agreements with major parts suppliers. This strategy helps independent distributors stay competitive in the face of large multinational companies.

Members of GROUPAUTO gain access to advantageous pricing and conditions through the organization's framework agreements, which encompass over 500,000 original equipment and aftermarket parts. Additionally, GROUPAUTO facilitates supply chain logistics, enhancing the efficiency of cross-border parts distribution.

I wrote extensively about Group Auto CEE and its structure here:

Formed in 2006, GROUPAUTO CEE has successfully assembled a coalition of premier independent automotive parts distributors across Central and Eastern Europe. This alliance comprises over 30 member firms operating in 11 different countries.

Joining this Group, new partners aim to bolster their independent presence in local markets, broaden their business scope, and seize new opportunities with top suppliers, as recommended by Groupauto and Alliance Automotive Group.

GROUPAUTO Poland includes:

AUTOPARTNER

AUTHOR

AUTO-BAY

BHMD

FREE

DBK PARTS

EDPOL

FORTITUDE

MOTOROL

E-MOTO

TRADELOPEX

DARMA

HART

SZIK

In a significant move, Alliance Automotive Group (AAG) acquired GROUPAUTO Poland in 2017. GROUPAUTO Poland’s impressive network includes 250 distinct retail outlets, collectively employing over 3,500 individuals. The combined revenues of these outlets amount to approximately €550,000,000.

GROUPAUTO Poland, by the numbers:

141.5k sq ft meters of warehouse space

EUR 550 million is the group's annual turnover for 2018.

1993 employees

107 points of sale

280 car repair shops

Titi’s take

Despite the diversity of this group of companies, creating a logistical backbone that ensures the stock and delivery has the advantage of distributing products to an equally diverse client base from various backgrounds, with different developments and approaches. This makes Groupauto a formidable force not just in Poland, but wherever it is present.

I highly appreciate this approach: pragmatic in logistics/supply but extremely flexible in sales. Congratulations on the idea and execution!

5. MOTO PROFIL

Established in 1993, Moto-Profil Sp. z o.o. stands as one of Poland and Central Europe's premier and most established distributors of automotive parts and accessories. They have been pivotal in importing and representing key global manufacturers of components essential for the maintenance of passenger and delivery vehicles. Additionally, they provide workshop equipment and advanced IT solutions to their business partners.

The distribution network, comprising wholesalers and automotive stores, enables them to serve over 15,000 car workshops nationwide. Moto-Profil holds the distinction of being one of the two Polish members of TEMOT International, a global network comprising the world's leading automotive parts distributors. Their active participation in the Association of Automotive Parts Distributors (SDCM) further highlights their industry prominence.

Here is a list of the biggest shareholders:

Moto-Profil founded the ProfiAuto brand, the largest in Poland and a major player in Central and Eastern Europe, encompassing a network of professional wholesalers, retail stores, and automotive workshops. Over the years, Moto-Profil has been at the forefront of introducing innovative technological advancements in the workshop sector, including the ProfiAuto app and the ProfiAuto Virtual Workshop.

The company is making significant strides in the European market, continuously broadening its network of business relationships. Moto-Profil's ProfiAuto network now encompasses over 240 shops and wholesalers, along with more than 2150 car services across Poland, the Czech Republic, and Slovakia. This makes it the largest network of its kind in the domestic market for parts distributors and garages.

‘We are pleased that we can count another year as successful both from the commercial perspective and in terms of the development of modern technologies for the industry. A new parts catalogue and an extension of the commercial offer will give our European customers even more opportunities for business growth. And this is what it is all about – to move forward and choose prospective solutions, ready to be implemented both today and in the future,’ stated Michał Tochowicz, President of Moto-Profil (2022)

Moto-profil, by the numbers:

80k square meters of storage space

1400 wholesale companies supplied in Poland

350k SKUs

25 countries where they deliver

1000+ employees

Titi’s take

Moto Profil is in a phase of reinvention after changing its shareholder structure. I personally knew the former owner and can say he was committed to developing the company in a somewhat unconventional way: only offering overnight delivery, maintaining a single central stock, and running an excellently managed fleet.

The new direction already includes another logistics hub, likely for Warsaw and the Baltics, and expanding routes to Germany, Czechia, Austria.

In my opinion, Moto Profil is currently searching for its identity. I have great confidence that the young team formed by Mr. Tochowicz won't be reduced but will be allowed to help in finding/creating a new identity. It needs a master's touch to bring an idea to life or to redirect it.

Let's hope that Moto Profil won't be swallowed up by the 'peloton' but will remain a strong entity, generating new ideas and projects.

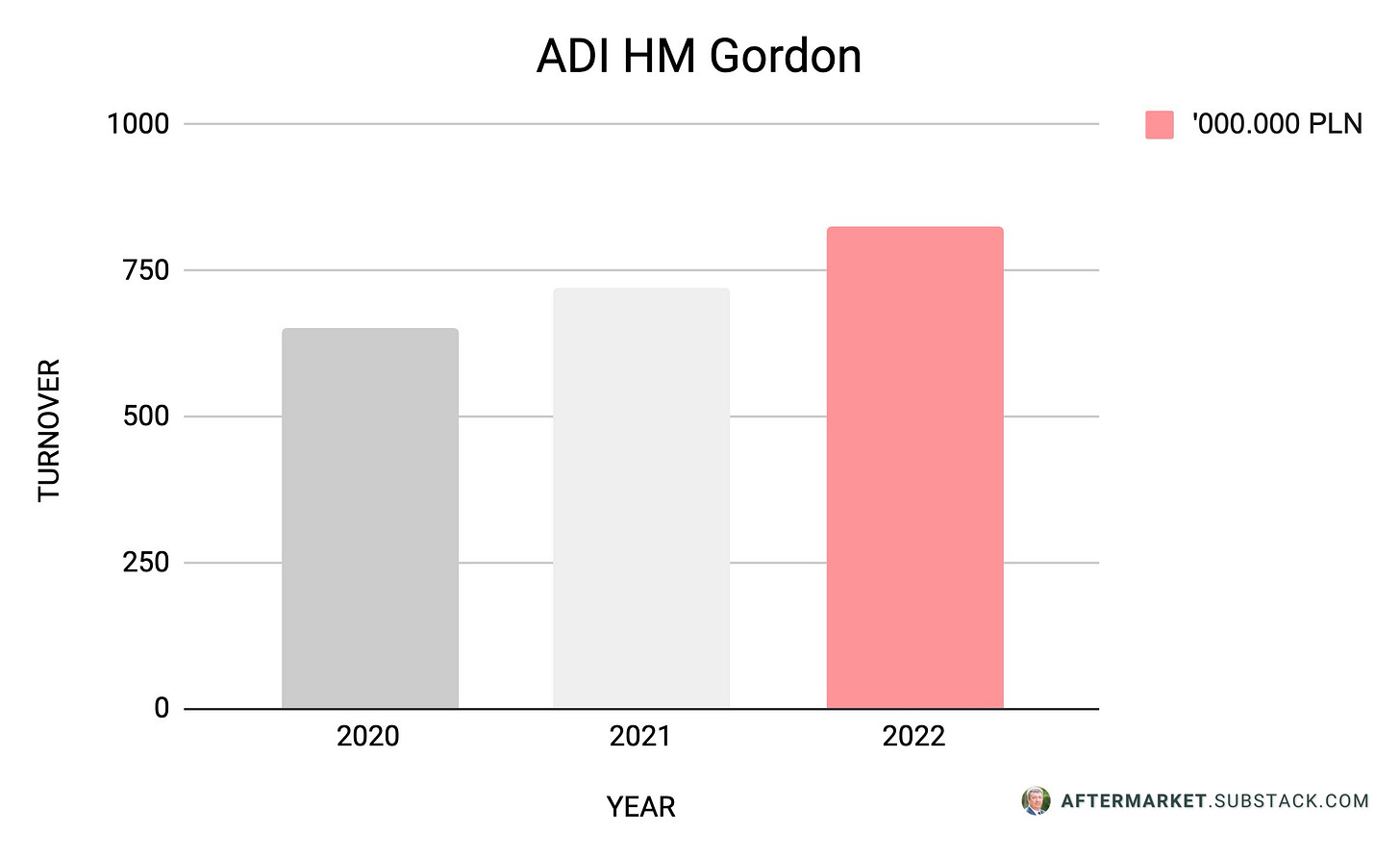

6. AD AUTO - Gordon Distribution Polska

Founded in 1991, GORDON, an automotive wholesaler, initially operated from rented facilities in Bydgoszcz. However, the company's swift growth soon necessitated an expansion of its warehouse and office spaces. Consequently, in January 1999, GORDON relocated to a newly constructed building on the outskirts of Bydgoszcz. Over the years, the company has continuously upgraded its facilities, now boasting a warehouse area of 35,000 m2.5

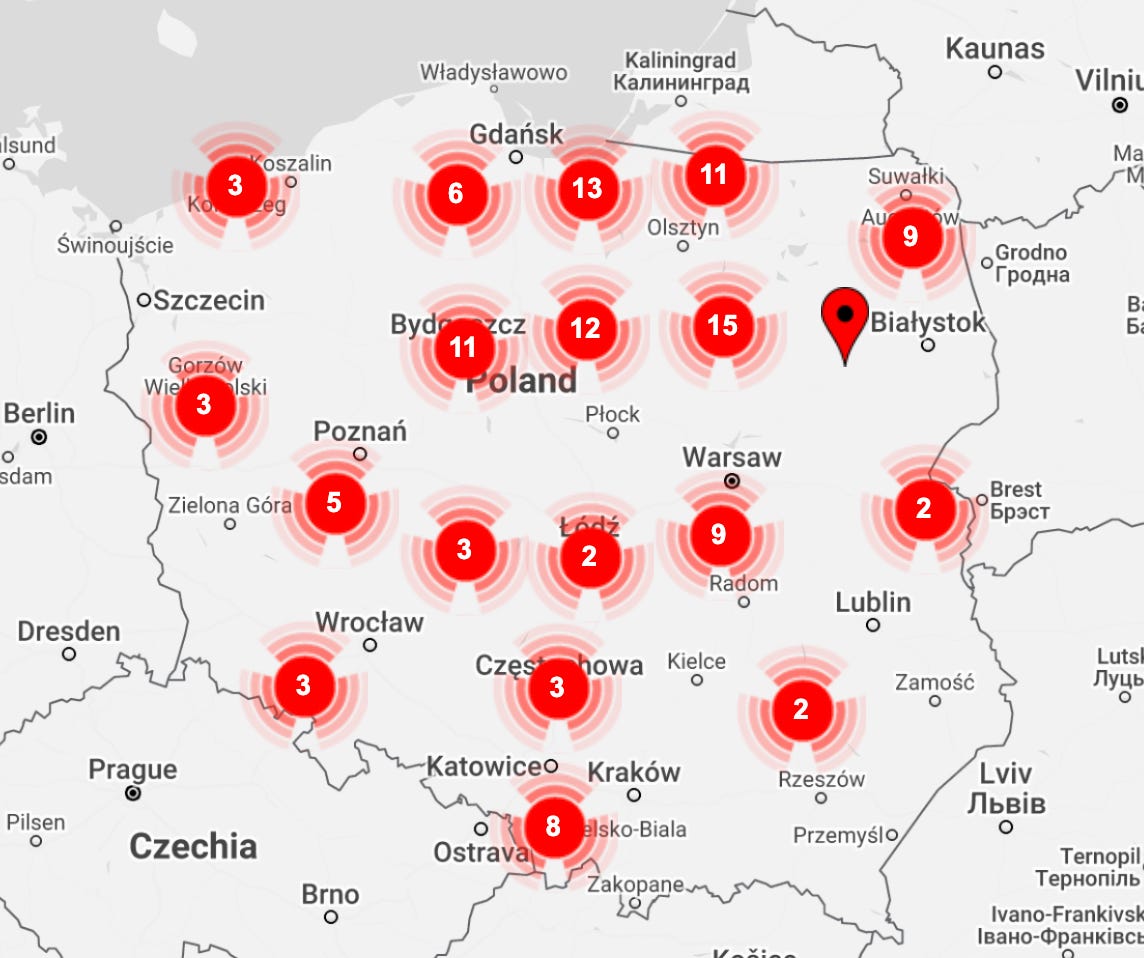

The company experienced significant growth through the establishment of new sales outlets. This rapid progress has been made possible through effective management, a highly skilled team, and adaptability to customer needs and evolving market conditions. The company's operations span across Poland, with over 150 branches currently established nationwide.

Since its inception, GORDON has excelled in prompt delivery of goods, a factor that has significantly contributed to its customer base growth. Currently, the company serves over 150,000 customers, ensuring that orders are delivered within 24 hours of placement. GORDON regularly enhances its inventory with new products each month, which has consistently driven an increase in sales.

The year 2019 marked a significant transition for Groupauto Polska. The company, as a wholesaler, exited GA PL and joined AD International, becoming the 25th partner in the chain. President of the Gordon Automotive - Jacek Gordon, declared: “We look forward to leveraging our ADI know-how business in key areas such as concept marketing (AD Garage), technical data and mechanical education (Eure! Car) and supplier/brand portfolio. This development will benefit our customers and accelerate our current growth strategy.”

We have come to know Gordon as a highly professional and dynamic company with solid foundations and ambitions that match ours. From January 1, AD Polska and their team will be our gateway to introducing the AD concept to the Polish aftermarket, to the benefit of customers and suppliers.

President of ADI - Thomas Vollmar

ADI HM Gordon by the numbers:

Over 150 branches and warehouses across Poland

35.000 square meters of warehouses

Over 1000 employees

Titi’s take

HM GORDON is a company recognized for its development ambitions, especially thanks to their trade policy, which has been expanding for the past 10-15 years. The move towards ADI from the position of the first player in Groupauto shows that these ambitions were not satisfied by GAU.

On the one hand, ADI has to demonstrate that it can compete on an extremely crowded and strong market, i.e. Polish, where it exited by selling the former network to LKQ. On the other hand, GORDON has the ability to do more with the right international support. I don't think that the success of ADI in Romania can be replicated, but surprises are always welcomed.

In their case, now and in the near future, we can be certain of one thing: GORDON is not for sale!

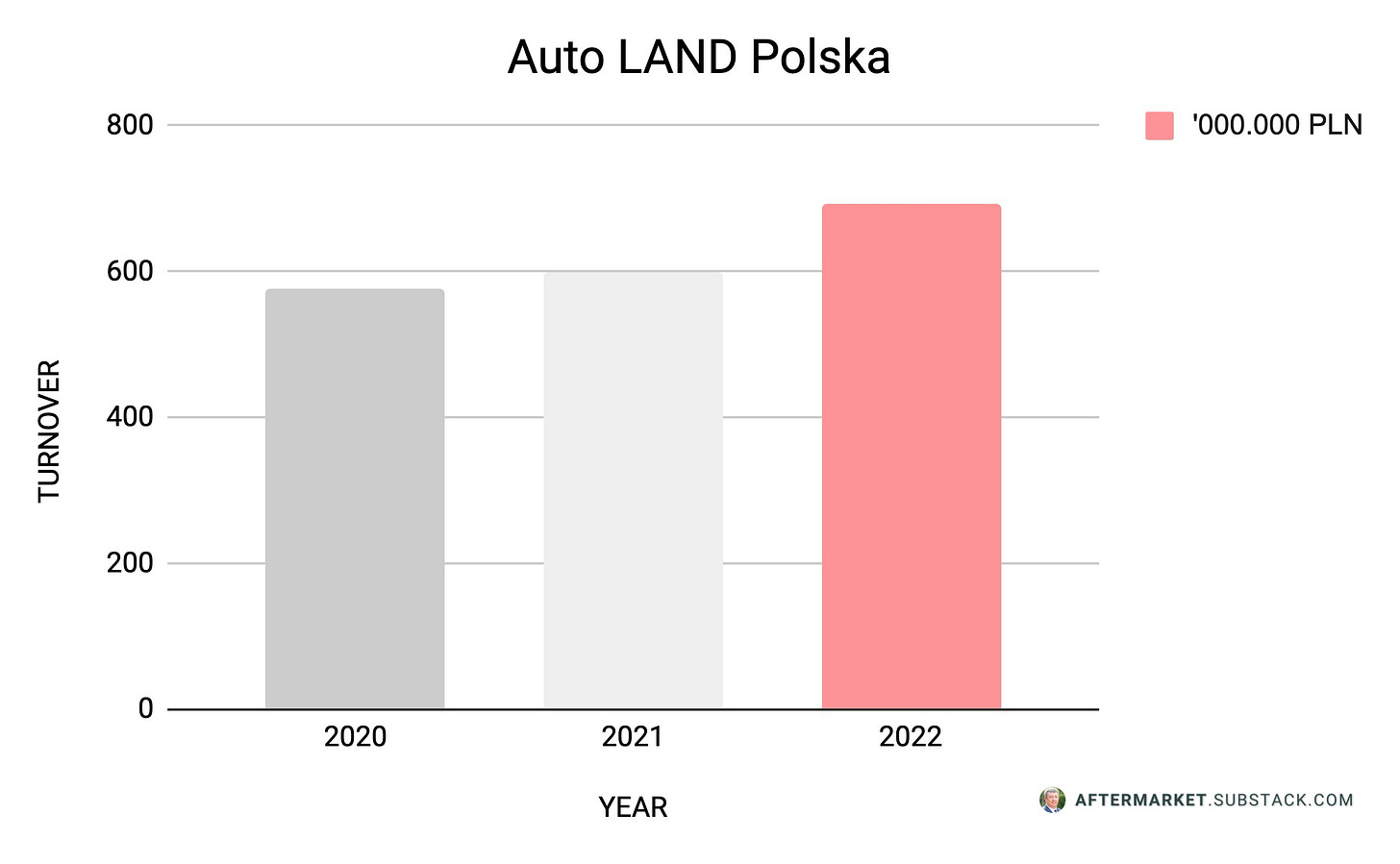

7. AUTO LAND

This year also brings changes for smaller market players. Arpol Motor Company , a significant distributor in central Poland with nearly 30 years of history, with 15 branches in the Kuyavian-Pomeranian and Masovian Voivodeships, merged with Auto Land Polska SA , which has been successfully building a nationwide distribution network since 1991, currently based on 90 branches. And, as it turns out, he hasn't said the last word on this matter yet.

Boasting an expansive network of over a hundred branches, Auto Land Poland offers quick access to a diverse range of products. Established in 1991, the company has been focused on the wholesale and retail sale of parts for passenger cars and delivery vans of all brands, including both European and Asian makes. The cornerstone of its distribution strategy is to provide optimal service, a broad selection, and ready availability of goods.

Efficient logistics play a crucial role in delivering professional service. The company operates its own fleet of vehicles, conducting deliveries twice a day, both during the day and at night. A skilled team of well-trained employees is dedicated to assisting clients in finding the best solutions daily. The extensive inventory includes nearly 220,000 items in stock. Beyond automotive parts, the company's product line extends to service equipment, accessories, automotive chemicals, oils, tires, workwear, and safety products. The product range encompasses both globally renowned brands and esteemed Polish manufacturers.6

Auto Land, by the numbers:

121 branches

225k SKUs

1067 employees

Titi’s take

Although it lost important steps in the internal competition with other players who bet on the stock market capitalization and on an impressive logistic development, Auto Land seems not to have said its last word. The merger acquisition with smaller players and, most importantly, the association within NEXUS Automotive with INTER LAND, clearly shows me that the ambitions of Auto Land Polska have been reborn.

I am sure that we will hear many good things about Auto Land, one of the first import auto parts distribution companies in Poland. I say this because they have an already famous and excellent relationship with their clients.

Let’s remember that the great battles are won in the trenches.

Conclusions & Market Overview

Titi’s Take

Poland is the largest Aftermarket market in Central and Eastern Europe (CEE), in terms of the number of cars, number of garages, and also in auto parts sales. It's a market that has systematically developed over the last 30 years, with an undisputed leader until now: Inter Cars.

Since the pandemic period, which did not affect the Aftermarket market too much, major players such as Moto Profil and Auto Partner SA have begun a fierce battle to win the Polish market and beyond. Their expansion into emerging markets like the Czech Republic, Germany, and Austria has strengthened their financial positions. On the contrary, Intercars Poland has one of the lowest growth rates among all the countries where the company operates branches, so things have balanced out.

The consolidation of several distributors under the Groupauto brand, the development of the ELIT Poland network (formerly ADI), and ADI's re-entry into Poland through the rebranding of the former outsider, GORDON, all make the Polish market increasingly consolidated and competitive. I believe this is the reason why Swiss Automotive Group is delaying its entry into this market, even though preparations at both the logistical level (through the opening of the Prague hub) and staff level (by bringing in the former logistics manager of InterCars Poland, Robert Kierzek) are complete.

I personally believe it's just a matter of time before Poland welcomes its first true new entry to the market. This is because, to the surprise of many specialists, the PSA Group has become increasingly interested in the Aftermarket market. DISTRIGO, which is the PSA Group's auto parts distribution company, will distribute not only OEM parts but also Aftermarket brands - including their own brand, EUROREPAR. Coupled with an aggressive partnership policy with IAM garages under the EUROREPAR Car Service brand, it can become a formidable adversary.

The PSA Group, through the voice of the General Director of PSA Poland, Wojciech Mieczkowski, says: “We want the PSA Group to be a very important player in the aftermarket market, to be at the forefront when it comes to after-sales service. Of course, the network of authorized service centers is very important to us, currently there are over 200 points and customers rate it very highly. But on the other hand, we realize how huge the market exists outside the ASO. Customers with older cars are looking for alternative solutions and independent networks. Without strengthening our position in this area, it is difficult to talk about strong growth of the PSA Group.”

Therefore, following DISTRIGO's offensive in the United Kingdom, the experience gained will be used for entering the next market targeted by the PSA Group, Poland. I see it as a bold move, a tremendous challenge for both PSA and the other players in the Polish Aftermarket market.

SAG holds a special place in my heart as a family-owned business rooted in Switzerland. With a presence in countries like Switzerland, Austria, Belgium, Italy, Romania, Hungary, Slovakia, and Slovenia, I can't help but wonder if Poland will be next on their list.

During a 2019 interview with Motofaktor.pl, Robert Kierzek, the purchasing director at SAG, shared insights that really resonated with me. He mentioned that Poland might very well be at the forefront of SAG's expansion strategy. The idea of developing the distribution network in Central and Eastern Europe, with Poland potentially being a significant part of this plan, is something I'm eagerly anticipating. It seems like a natural progression for SAG, and I'm curious to see how this strategy will unfold in the near future.

With these two threats knocking at the door, the Polish automotive aftermarket market continues on its path: consolidation, opening of new logistics warehouses (including for the old-school Moto Profil, which has entered a new era) and the globalization of sales.

I wish everyone best of luck!

Titi

Interested in more?

Schedule a 1:1 call - to better answer your questions about any country or company in Central and Eastern Europe that you may be interested in.

Leave your feedback in the comments section - I would be interested in learning your opinion on the Polish market or any other hot topics

Thank you for reading and supporting my work! I use all my free time to put together this information and it means the world to me that people like you find it useful!

![[Company Overview] LKQ Europe](https://substackcdn.com/image/fetch/$s_!D1tC!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6c9eeafc-8f82-4d58-bc13-1f12e10fa039_2408x1236.jpeg)

Very useful. May I know how did you get the 2022 Polish Wholesalers Data? Thanks