Hungary Automotive Aftermarket in 2024

A comprehensive overview of the Hungarian market and top wholesalers

When it comes to Europe’s automotive aftermarket, the spotlight often shines on major manufacturing powerhouses in Western Europe. Yet, tucked in Central Europe lies Hungary—a country that has quietly but impressively built itself into a formidable hub for auto parts distribution. It’s a market where deeply rooted mechanical traditions intersect with cutting-edge e-commerce, where loyalty to homegrown brands coexists with the eager embrace of global innovation.

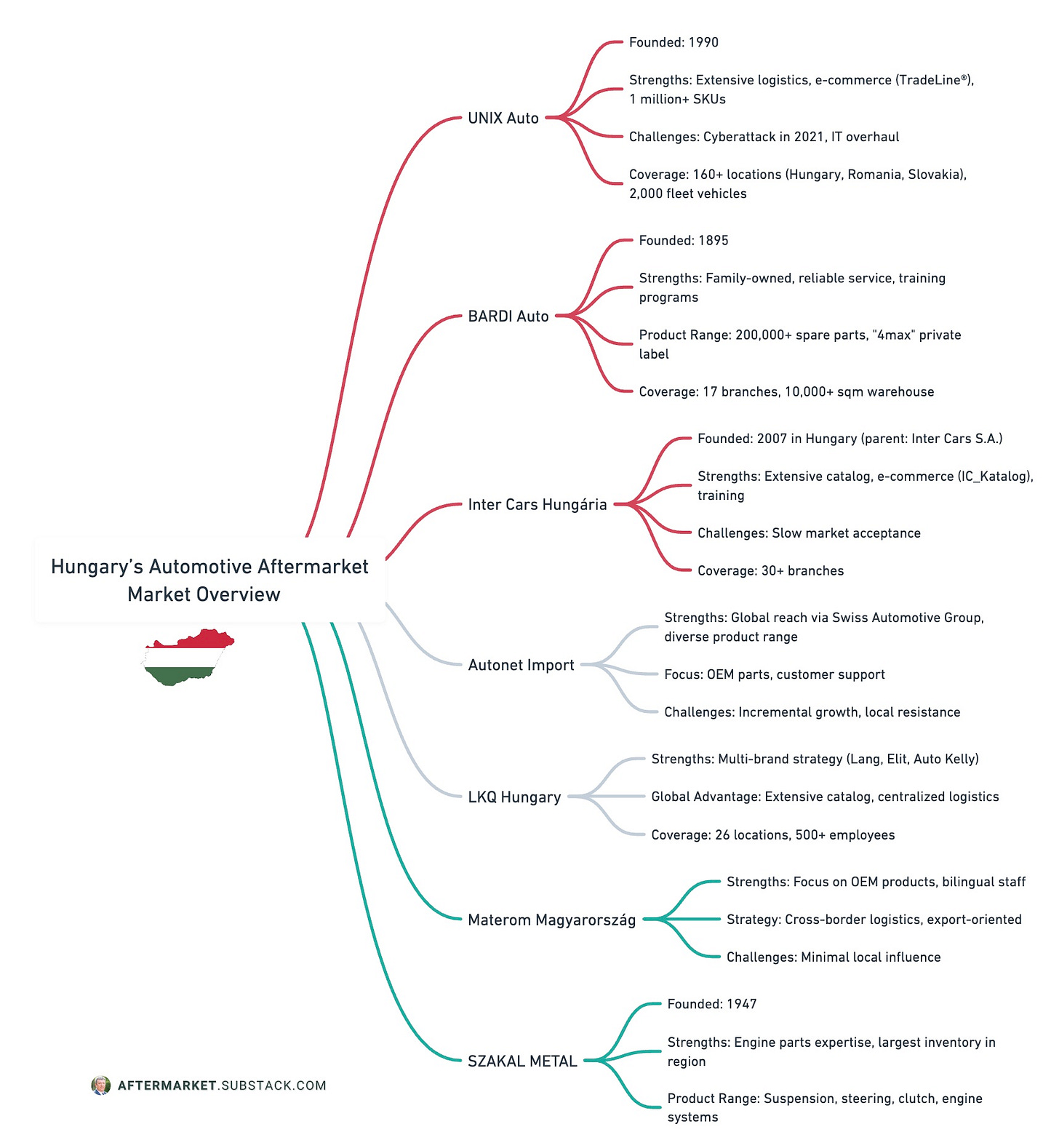

In this evolving landscape, industry veterans that emerged after Hungary’s transition to a market economy now stand shoulder to shoulder with multinational giants. Local distributors like UNIX and BARDI command fierce brand loyalty, while global players such as Inter Cars, LKQ, Autonet, and Materom bring in international expertise.

Why does this market matter? Because Hungary’s unique conditions—including unwavering customer allegiance to native distributors—place high demands on service speed, product range, and post-sales support. New entrants must adapt quickly, tailoring offerings to local preferences if they want to earn a seat at the table. At the same time, Hungarian companies that expand across borders prove that a strong heritage can be the perfect launchpad for regional or even global success.

Hungarian automotive aftermarket overview

As regional markets continue to evolve, Hungary’s automotive sector shows a healthy mix of tradition and innovation. Some companies have been operating since the early years of the country’s transition to a market economy, while others are part of global conglomerates that bring fresh perspectives and international expertise. You’ll see a focus on quick delivery, extensive product ranges, and cutting-edge e-commerce, often rivaling Western European peers.

A unique characteristic of the Hungarian automotive aftermarket is the unwavering loyalty shown by many local customers. Historically, they’ve preferred buying from homegrown distributors, creating a tougher path for foreign newcomers. Yet, this environment has also encouraged international players to adapt, localize, and sometimes even join forces with domestic operations to better serve Hungary’s demanding market.

Over the next section, we’ll dive into the stories, structures, and specialties of Hungary’s top automotive parts distributors. Each organization has carved out its niche—be it through pioneering e-commerce solutions, investing in massive warehouse expansions, or simply focusing on superior customer service.

Whether you’re new to the Hungarian automotive scene or have followed it for years, consider this your roadmap to a market that is both fiercely competitive and remarkably friendly to those who deliver on quality, speed, and local expertise.

If I had to simplify the market, we would have the top 3 - Unix, Bardi, Intercars, and then the rest:

Unix Auto Kft.

UNIX Autó Kft. (UNIX) has an origin story that reads like a classic tale of entrepreneurial spirit. Founded in 19901, just after Hungary’s transition to a market economy, the company planted its roots in Budapest with the goal of providing rapid access to automotive spare parts. Its founders spotted an opportunity to bring world-class logistics and IT systems to local garages that were suddenly free to operate without the constraints of a planned economy.2 Today, UNIX stands among the largest and most established automotive parts distributors in the country.

Operating from its advanced central warehouse in Budapest, UNIX has built a comprehensive logistics system that covers every corner of Hungary. The company boasts an extensive network of branches—from bustling urban centers to smaller towns—ensuring that parts get delivered promptly, whether you’re located in downtown Budapest or a rural village. Their delivery fleet, said to comprise over 2,000 vehicles3, logs thousands of kilometers daily, guaranteeing a level of coverage and speed that’s unmatched in much of Central Europe.

When it comes to product range, UNIX doesn’t hold back. Their catalog features a staggering number of spare parts—over 1 million SKUs—catering to passenger cars, motorcycles, and even light commercial vehicles. They represent a wide array of top-tier international manufacturers, as well as their own private-label brands. Whether you’re after premium components or more budget-friendly alternatives, UNIX ensures customers have the flexibility to match both their performance requirements and price points.

UNIX was one of the first in Hungary to recognize the potential of e-commerce in the automotive parts business. Its proprietary TradeLine® software offers detailed part lookups and real-time ordering for B2B clients, while a consumer-facing webshop complements traditional in-person purchases. These platforms bring reliability and speed to their transactions, and they are continuously updated to stay in tune with ever-changing automotive needs. Combined with a mobile app, UNIX’s digital ecosystem serves as a model of efficiency and innovation in the Hungarian market.

On March 30th, 2021, UNIX was hit by a cyberattack that devastated the company4. Their operations were shut down entirely and the company brought to a standstill. Undeterred, the company’s specialists rebuilt the system, successfully relaunching their core TradeLine® software on April 2, 2021. In the wake of this crisis, the company invested around half a billion forints in IT upgrades, overhauled its entire network infrastructure from scratch, and expanded its IT department.

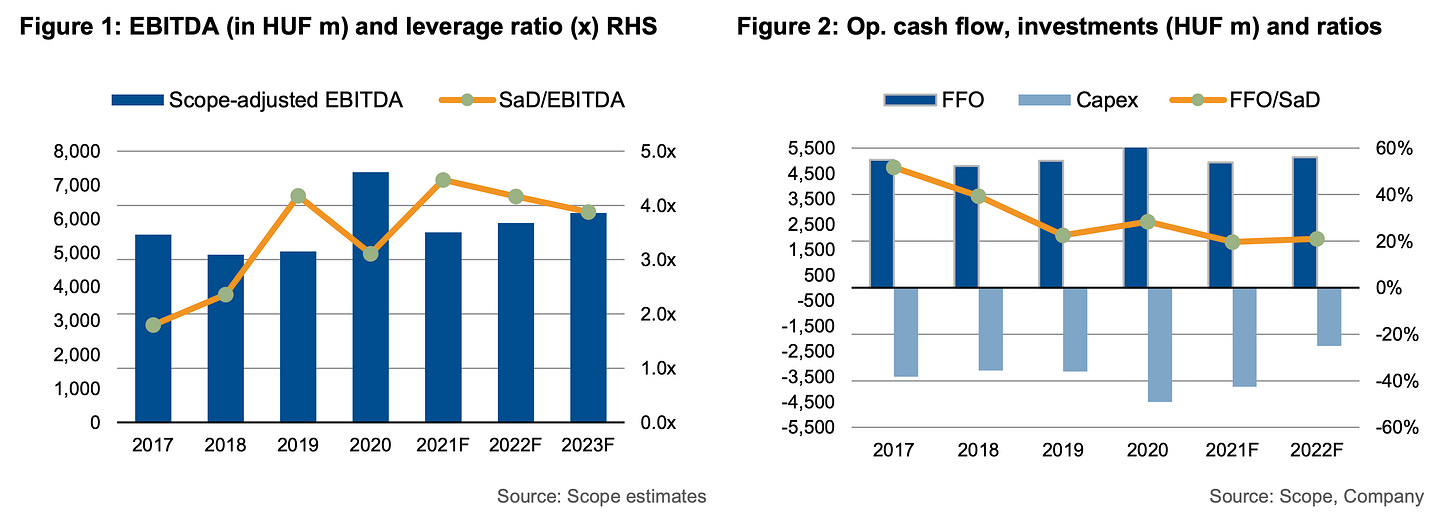

UNIX pursues a conservative financial policy, their own capital now reaches HUF 15 billion. The EBITDA trend shows some fluctuation but is expected to decline slightly in 2022 and 2023, while the leverage ratio remains well below 4x. The company's cash flow is expected to remain negative in 2021, with FFO/SaD declining, while capex increases. As stated in the report, “although Unix Autó does not have a publicly stated financial policy, but has expressed an ambition to keep the leverage ratio below 4x.”

Over the years, UNIX has garnered a reputation for robust service and unwavering customer satisfaction—evidenced by multiple industry recognitions, including membership in the German ATR group. The company also invests in training via the UNIX Academy, ensuring that both staff and partners stay current with modern automotive technologies.

By the numbers:

Founded in 1990

16 million items in stock

200,000 items moved daily

15,000 m² central warehouse floor area

160+ locations across 3 countries:

69 stores in Hungary

32 stores in Romania

4 stores in Slovakia

2,400+ employees

2,000+ fleet vehicles

10,000+ daily users of the TradeLine® software

HUF 15 billion: Own capital

Titi’s Take

UNIX serves as an inspiration for every entrepreneur striving to achieve the best in their endeavors. Constantly innovating, always on the lookout for new opportunities, and backed by excellent analytical capabilities, UNIX has firmly established itself as the leader in Hungary's aftermarket auto parts market.

The indecision of former market leaders during their acquisition by a multinational corporation positioned UNIX as the leader, and now as the undisputed market leader.

UNIX capitalized on the situation and widened the gap ahead of BARDI, reaching a market share of 40% in Hungary at one point.

I have always admired their business model, which combines B2B and B2C approaches, offering tailored stock and pricing options for each customer segment. In Romania, for example, the lack of a B2C option among major distributors not only attracted UNIX to this market but also spurred the emergence of large online retail stores.

Their online sales platform is now highly efficient and appreciated across the entire Eastern European market. This comes after the setback in 2021, when a group of hackers disrupted UNIX's operations for a period. The team rebounded, started almost from scratch, and now boasts one of the most advanced webshops in the industry.

Having come to know UNIX primarily through its Romanian branch, I cannot help but notice the significant employee turnover there (with the exception of senior management, which remains unchanged). Perhaps the situation is better in Hungary, where a sense of nationalism likely plays a key role.

In conclusion, UNIX is the reason other multinationals have failed to succeed in Hungary, including LKQ, Inter Cars, Autonet Import, and AD Auto Total. Excellent organization, well-managed inventories, an extensive (sometimes excessively large) fleet, and a highly efficient distribution system make UNIX the uncontested leader of Hungary's market.

It is up to the management to keep their team engaged, remain open to innovation, and continue their work without expecting applause. Because they know their worth, and it shows.

Bardi Auto

BARDI Auto emerged as a family business that turned its commitment to people and community into a competitive edge. From its Budapest headquarters, the company grew steadily, guided by principles that prioritize team well-being and consistent, quality customer service.

In 1895, 130 years ago, József Bárdi opens a shop for rubber goods, sewing machine parts and car lamps in Gyár Street (now Jókai Street) in Budapest. Despite competing against international giants, BARDI has carved out a loyal base through honest dealings and reliable product offerings.

Carrying more than 200,000 different spare parts, BARDI meets the needs of drivers for most makes and models found on Hungarian roads.5 Beyond distributing big-name international brands, the company also operates its own private label, “4max,” positioned as an affordable yet dependable option. This diversification serves a broad range of customers, from mechanics seeking premium solutions to consumers wanting cost-effective alternatives.

A key to BARDI’s success is its efficient logistics infrastructure. Operating a central warehouse and 17 branches across Hungary, the company ensures wide coverage and quick turnaround times. Their warehouse in Budapest extends over 10,000 square meters, packed with thousands of SKUs that cater to various segments of the market—from small garages in need of a few parts to larger chains placing significant orders.

While product variety is critical, BARDI understands that solid customer support can be just as important.6 The company offers training programs and workshops for mechanics, invests in technical hotlines for real-time troubleshooting, and continually updates its e-catalog for seamless ordering. Their approach fosters long-term relationships and ensures that both new and returning clients feel supported at each step of their purchase and maintenance journey.

Its decades of solid growth and membership in TEMOT International7 highlight the company’s ongoing commitment to raising standards. Looking forward, BARDI aims to expand its online presence, upgrade digital solutions, and continue providing reliable access to automotive parts for an ever-growing customer base.

By the numbers:

Founded in 1895

130 years of history

150 branches opened by 2019

10,000+ square meters of central warehouse area

2014: Year automated central warehouse was implemented

200,000+ spare parts in the product range

60+ product groups covered

100+ brands represented

24 hours: Typical delivery timeframe

1,830 employees

Financials

6.94% increase in Net Sales Revenue Growth

-36.62% EBITDA Change

14.61% increase in Total Assets

-6.27% Net Profit Margin

Net Revenue (HUF): 80,677,994,000

Net Revenue (EUR): 210,768,576

Titi’s Take

BARDI Auto holds the second position among aftermarket auto parts distributors in Hungary. A family-owned company, it is highly respected in the market for having forged its own identity and approach to business, even while competing with a giant like UNIX, in an extremely competitive landscape.

I greatly admire how BARDI takes care of its team and its people—this is why I emphasized its nature as a family business.

BARDI has always played its strengths exceptionally well. Unfortunately, it is not listed on the stock exchange, but it would be one of the companies I’d invest in without hesitation.

It is worth highlighting that the company’s management is very coherent, making decisions based on long-term perspectives rather than immediate interests. Professionalism and pragmatism are clearly evident in their leadership approach.

They recognized the need to expand their distribution points and fleet and strategically developed in this direction.

I also took note that their expansion into other countries has been carefully planned. They took into account the significant number of Hungarian-speaking populations in Slovakia and western Romania and developed these areas first.

Inter Cars Hungária Kft.

Inter Cars Hungária Kft. entered the Hungarian scene in 2007, riding the success wave of its Polish parent, Inter Cars S.A.8 Despite being relatively new compared to several homegrown competitors, Inter Cars brought a fresh approach, shaped by expertise gained across Central and Eastern Europe.

From a central warehouse hub to a growing network of local branches, Inter Cars employs a hub-and-spoke model to serve Hungary’s garages.9 Deliveries are orchestrated with remarkable efficiency, aided by a robust logistics system. This network model allows the company to provide same-day or next-day shipping for a vast range of parts, keeping Hungarian customers satisfied.

Inter Cars does not shy away from offering an extensive selection: over a million SKUs, including passenger car and commercial vehicle parts. The breadth of product lines—ranging from internationally acclaimed brands to Inter Cars’ own private label, “Q-Service”—positions them as a one-stop shop for mechanics seeking varied solutions.10

In the Hungarian market, Inter Cars quickly recognized the importance of seamless online ordering, launching platforms like IC_Katalog for both B2B and B2C needs11. They also offer technical training via their Inter Cars Training Center, emphasizing not just sales but the overall knowledge base within the automotive repair community. This blend of e-commerce and professional development sets them apart.

While local brand loyalty can make life tough for foreign distributors, Inter Cars has steadily built its reputation by listening to customers and adapting to Hungarian norms. Though it may not reach market leadership overnight, its strong financial backing, persistent focus on technology, and broad product portfolio promise a bright future in Hungary’s aftermarket scene.

By the numbers:

Established in 2007, in Hungary

Parent company Inter Cars S.A. was founded in Poland in 1990

30+ Branches in Hungary

1 million+ SKUs in the product catalog

100+ Q-Service partner garages in Hungary (as of 2017)

Financials:

669.7 million PLN: Sales from January to November 2024

~157,152,203 EUR / 163,417,193 USD

6.4%: Year-to-date sales growth (January–November)

68.9 million PLN: November 2024 sales

~16,168,115 EUR / 16,812,669 USD

7.1%: Year-over-year sales growth in November

Titi’s Take

For more insights into Inter Cars and their operations, I recommend revisiting my post about Poland and the article dedicated to Inter Cars Poland.

I want to highlight an intriguing aspect: like other multinationals, the giant Inter Cars has experienced very slow growth in Hungary. The system and principles remain the same, but the challenge lies in market acceptance.

The Hungarian market seems to protect its local players exceptionally well. When a foreign company enters, automotive customers—stores and garages—are reluctant to switch from their long-standing suppliers to new ones.

This reflects a sense of national pride that I can understand, although such dynamics are absent in the Romanian market.

As a result, Inter Cars Hungary is developing slowly despite significant efforts. However, it is unlikely to ever become a driving force within the Inter Cars group.

Autonet Import Kft.

Carrying a diverse range of parts for both passenger and commercial vehicles, Autonet prides itself on a catalog that spans multiple global brands. Its cross-border collaborations mean it can swiftly source OEM parts and niche components, a particular advantage when Hungarian garages tackle the complexity of modern vehicles.12

Whether a small workshop or a large repair chain, Autonet’s operational ethos revolves around rapid fulfillment and customer support. The company invests in IT systems designed for real-time inventory tracking and ordering. This technological backbone underpins Autonet’s drive to deliver a frictionless customer experience, a quality that resonates with Hungarian mechanics on tight repair schedules.

Though Autonet has been in Hungary for years, its growth has been incremental rather than explosive. Local players tend to dominate, and the market can be wary of foreign ownership. Still, Autonet’s persistence and global backing allow it to maintain its foothold, steadily improving service offerings and building trust with Hungarian clients over time.

By leveraging the Swiss Automotive Group’s international reach, Autonet continues to explore new product lines—especially for electric and hybrid vehicles. Their strategy focuses on building deeper partnerships with local garages, training programs, and advanced digital systems, all of which bode well for Autonet’s position in the long run.

Titi’s Take

For more information about the Swiss Automotive Group, which includes Autonet Import, you can revisit my post about the group and the article about Romania, where I detailed Autonet Import’s situation extensively.

Despite having operated in the Hungarian market for many years, Autonet has not been able to break into the leading trio of local companies dominating the market. Numerous attempts have been made, some more aggressive, others more innovative, but the reality remains: a foreign company is destined to stay in the second tier of the rankings—not because it fails to do its homework or lacks the right people, but simply because it is foreign.

LKQ Hungary

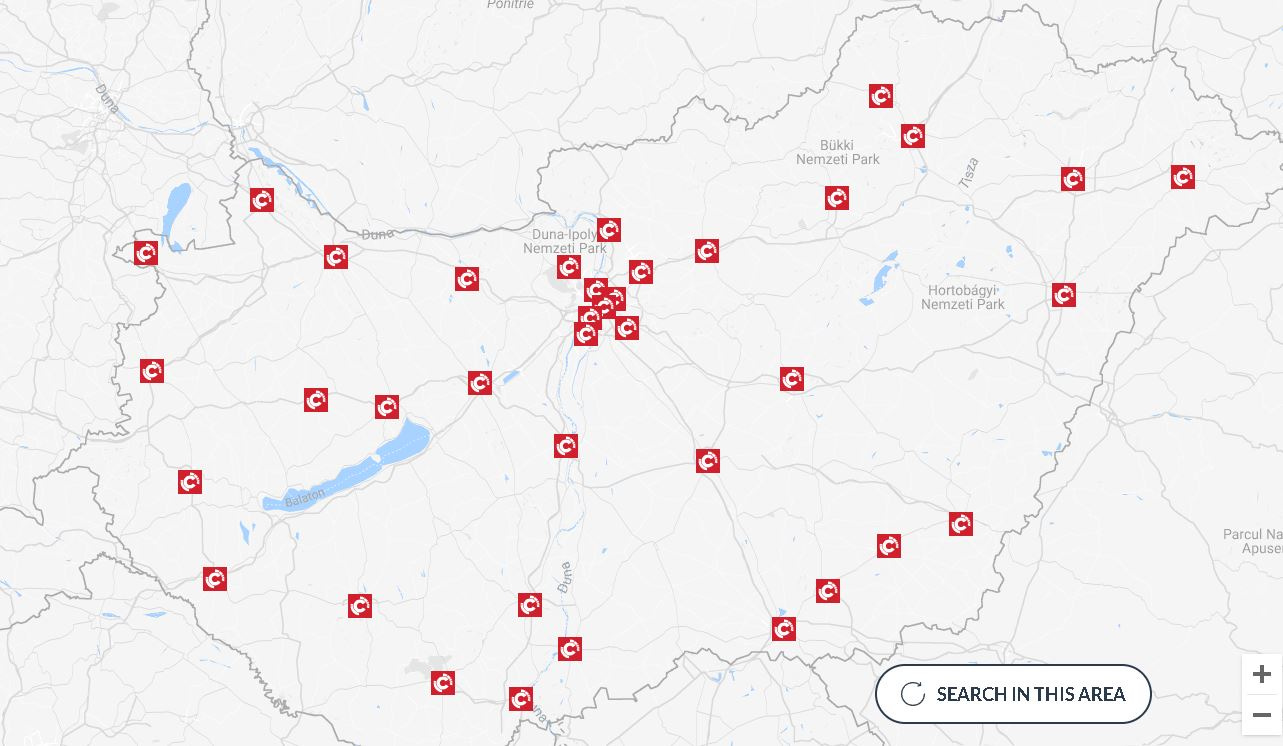

LKQ Corporation, a global heavyweight in the automotive industry, made its way into Hungary through a series of acquisitions involving established local and regional distributors. In short, Rhiag Group owns Lang Hungary, Elit, Auto Kelly, and Simimpex. In 2019, LKQ Corporation aquired a significant 39% minority share in Rhiag Group, which gave them access to the aforementioned companies. You can read more about LKQ Europe here:

Today, LKQ Hungary operates several brands under its umbrella—of which the biggest ones are:

Lang:

This is the primary entity representing LKQ Corporation in Hungary13

It was established following LKQ's acquisition of Rhiag Group in 2019

Focuses on distributing a wide range of aftermarket parts for cars and light commercial vehicles

“The latest financial highlights indicate a net sales revenue increase of 1.46% in 2023”14

Elit Hungary Kft.

A subsidiary of LKQ, operating under the Elit brand.

Elit was part of the Rhiag Group acquisition.

Specializes in distribution of quality aftermarket parts.

Known for its strong logistics network and technical support.

What sets LKQ apart is its strategy of maintaining multiple brand identities in Hungary. Rather than consolidating these acquisitions under one banner, LKQ leverages various players to target specific market niches. This multi-brand approach allows them to address different customer profiles—be it specialized workshops, price-sensitive garages, or premium-focused clients—while still benefiting from centralized logistics and purchasing power.

Each LKQ entity in Hungary carries an extensive catalog of parts and accessories for a variety of vehicle makes, including OEM-quality, recycled, and remanufactured options. LKQ’s global clout translates into significant purchasing power, which often means competitive pricing for Hungarian customers. And while each brand maintains its own online storefront, they share knowledge and back-end systems to keep operations smooth.

From the southern reaches of Hungary to the northern borders, LKQ’s network of branches and distribution centers prioritizes timely deliveries. The company invests heavily in IT infrastructure—whether in warehouse management, route optimization, or online ordering—to provide rapid fulfillment. This unwavering focus on technology helps LKQ compete head-to-head with local powerhouses in a market known for its preference for homegrown distributors.

Although LKQ has the advantage of global resources, breaking into the top-three rank in Hungary remains a challenge. Local competitors guard their turf vigorously, and many Hungarian garages remain loyal to national brands. Nonetheless, LKQ’s persistent expansion, targeted acquisitions, and robust digital presence could propel it up the leaderboard, potentially unseating some long-standing incumbents.

By the numbers:

Lang was founded in 1991 in Pécs, Hungary

500+ Employees

40,000+ Employees under LKQ Corporation

26 Locations in Hungary

20 Countries with LKQ operations globally

17.8 billion HUF turnover

~47 million EUR / 51 million USD

Titi’s Take

LKQ Hungary is now a conglomerate of companies—including Lang, Elit, Auto Kelly, and LKQ itself—that must be aligned to the same standards.

Its development has been slow and profit-focused, in contrast to the trends seen in Central and Eastern Europe.

With the recent change in group management, there is hope for coherent policies and substantial marketing budgets to position LKQ where it belongs: among the top three distribution companies in Hungary. Perhaps, it may even challenge BARDI for the second spot.

Materom

Materom, a prominent Romanian distributor, started this cross-border strategy to leverages Hungary as a stepping stone, capitalizing on the country’s central location and well-established trade routes.15

This customer-focused approach pairs with a robust logistics network that prioritizes timely deliveries, an essential factor in OEM supply chains where speed and authenticity are crucial.16

By the numbers:

Please see the MATEROM group figures in my article Romania Afermarket Car Industry 2023

Titi’s Take

Materom it is one of the first aftermarket distributors in Central and Eastern Europe to recognize the potential of OEM products, starting with Mercedes, then expanding to Renault, Skoda, VW, and others.

From what I’ve observed, a significant portion of these products is destined for other markets, as the high revenue from OEM products compared to other aftermarket distributors cannot be otherwise explained.

MATEROM's influence in the Hungarian market is minimal, as local Hungarian companies dominate. If multinational giants like Inter Cars struggle to unlock the potential of this market, how would MATEROM succeed?

SZAKAL METAL Groupi

Founded in 1947, SZAKAL METAL began its journey focusing on one of the most complex segments of car maintenance: engine parts. Over time, it established a solid reputation for stocking hard-to-find items and offering deep technical knowledge. Although the company eventually branched out into broader categories, its engine expertise remains a defining feature.17

Thanks to a unique warehouse stock—one of the largest in the region for engine components—SZAKAL METAL can promptly supply parts for a wide variety of European and Asian models. This deep inventory is supported by advanced inventory management and a network of local representatives, ensuring orders are processed quickly and accurately.18

The list of Members of SZAKAL METAL Groupi include:

Hungary: Szakál-Met-Al Zrt.

Czech Republic: Szakal-Met-Al S.R.O

Romania: Szakal-Met-Al S.R.L.

Croatia: Szakal-Met-Al D.O.O

Serbia: Szakal-Met-Al D.O.O

Ukraine: O.O.O.Szakal-Met-Al

Bulgaria: Szakal-Met-Al O.O.D

SZAKAL METAL isn’t just about moving boxes. The company firmly believes in sharing its decades-long experience with both domestic and international professionals. Regular partner meetings, participation in industry events, and training sessions help mechanics and distributors alike stay updated on the latest engine technologies and best practices.

Recognizing the linguistic and cultural ties with bordering regions, SZAKAL METAL ventured into Romania and Slovakia with relative ease. By tailoring its offerings to Hungarian-speaking populations in these neighboring countries, the company has successfully replicated its Hungarian success story, while also broadening its revenue streams.

Szakal represents Febest Europe Distribution in Hungary19, which is the official Febest group supplier of auto parts for the European and North Africa markets. Febest parts are being used in repairs of Suspension, Steering, Clutch and Brake systems, Engine systems, Transmission and Body. Most of the parts are suspension components for Asian passenger cars.

By the numbers:

75 years of experience

45 shops

23 services

500+ brands

Titi’s Take

Szakal MET-AL is a particularly interesting company, initially carving out a niche in engine parts. Over time, its activities have evolved, and the portfolio is now quite diverse.

I believe the company currently holds one of the largest engine parts inventories in Central and Eastern Europe, along with the essential expertise for accurate identification.

Its operations in Romania and Slovakia were a natural extension, following the path of Hungarian-speaking populations.

Szakal Met-Al is a company to keep on the watchlist.

Conclusions

Hungary’s automotive aftermarket offers an intriguing mix of local tradition and global innovation. Homegrown companies like UNIX, BARDI, and SZAKAL METAL leverage long-standing roots, loyal customer bases, and deep market insight to stay ahead. Meanwhile, international players such as Autonet, LKQ, Inter Cars, and Materom bring fresh perspectives, global purchasing power, and cutting-edge digital solutions—challenging the status quo and often raising industry standards across the board.

Despite this intense competition, the overarching theme in Hungary remains one of adaptability and customer-centric thinking. Whether it’s rolling out advanced e-commerce platforms, investing in training for mechanics, or offering a broader selection of OEM parts, each distributor is pushing the market forward. And while local loyalty can be a barrier for newcomers, it has also nurtured an environment where quality and reliability reign supreme.

For those willing to navigate Hungary’s nuanced retail and service landscape, the potential rewards—steady growth, enduring customer relationships, and regional expansion—are well worth the effort. The Hungarian aftermarket isn’t just about selling car parts; it’s about building trust, staying agile, and keeping pace with a market that never stops evolving.

![[Company Overview] Inter Cars: Accelerating Success](https://substackcdn.com/image/fetch/$s_!P0hi!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff8a64f87-4b90-435f-8a00-dd83fd69b424_1200x600.png)

![[Company Overview] LKQ Europe](https://substackcdn.com/image/fetch/$s_!D1tC!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6c9eeafc-8f82-4d58-bc13-1f12e10fa039_2408x1236.jpeg)

I will check my documentation and i will correct the article if it is something wrong about it...

Domnule Piftor, organizatia Materom Magyarország Kft., nu exista. va rog sa retrageti informatia. Va multumesc.